News Analysis: Engaged Company Stock Index Results Too Compelling to Ignore

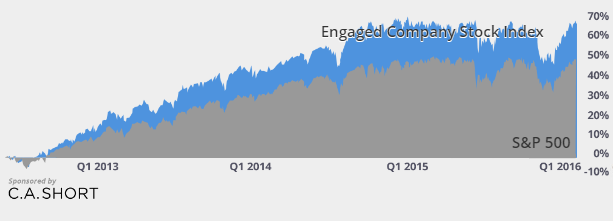

Now entering its fourth year, the Engaged Company Stock Index (ECSI), a partnership between McBassi & Co. and the Enterprise Engagement Alliance, has outperformed the S&P 500 by a whopping 21.5% including dividends, a performance that surpasses all but a tiny elite of money managers and hedge funds, as well as most of the funds in the US News & World Reports and Zacks fund rating services. Even more compelling, the performance has been consistent year after year, with less serious declines during market corrections than the general S&P index.

The ECSI was created to demonstrate the economics of having engaged employees, customers and communities – an underlying principle of Enterprise Engagement – by tracking companies over time based on a fixed start date. Although it has no holdings and is not an active fund, the ECSI is managed as if it were an Exchange Traded Fund (ETF). The ECSI is funded in part through sponsorships from CA Short Co., a leading recognition company.

The ECSI was created to demonstrate the economics of having engaged employees, customers and communities – an underlying principle of Enterprise Engagement – by tracking companies over time based on a fixed start date. Although it has no holdings and is not an active fund, the ECSI is managed as if it were an Exchange Traded Fund (ETF). The ECSI is funded in part through sponsorships from CA Short Co., a leading recognition company.

“Our goal is to use the principles of enterprise engagement to identify the companies most likely to benefit on a financial basis, to track those companies over time, and to adjust according to new data,” explains Bruce Bolger, President of the Enterprise Engagement Alliance. “We’re in the process of looking for a leading investment firm to sponsor the ECSI, because we’re only able to update the index once a year and there’s no way we can enable people to actually profit from this index at present.”

While the work of Alex Edmans, Professor of Finance at the London Business School whose research was recently published in the Harvard Business Review, demonstrating the long term benefits of engagement on stock price, the ECSI is designed to take that one step further by using these principles to identify and profit from specific performers.

Says Bolger: “I don’t think there’s any other company that can do what McBassi has done. Their Good Company Index started identifying companies with high levels of engagement long before most people began to think of business this way. They have demonstrated an ability to find and correlate data in all areas of engagement.”

The following Q&A with Dan McMurrer, Chief Analyst for McBassi & Co. and Manager of the ECSI, provides some key details about the process:

The following Q&A with Dan McMurrer, Chief Analyst for McBassi & Co. and Manager of the ECSI, provides some key details about the process:

Q: What changes have you made in the Index in the past year? Who was added? Who did you remove and why?

A: About 60% of the portfolio is the same as last year’s, meaning about 40% turned over. This is a fairly typical ratio, where between half and two-thirds of companies are held over in the portfolio while the rest are newcomers.

Specifically, the companies added were Alcoa, Allstate, Boston Scientific, Campbell Soup, CenterPoint, Cisco, Cognizant, CSX, Ecolab, Fluor, Hess, Humana, L Brands, PepsiCo, PPL, Prudential, Whirlpool and Whole Foods. Companies removed were Apple, Abbot, Allergan, Amgen, Anadarko, Air Products, Biogen Idec, Celgene, Delta, Deere, Ford, GE, Lockheed Martin, Medtronic, Microsoft, NetApp, Sherwin Williams, Southern and Unum.

The changes reflect a variety of different factors; I’ll discuss the two most important ones: First, the index is based on a company’s combined scores as what we call an ‘employer, seller and steward’ of the community and environment. Therefore, changes in a company’s score are certainly the most common reason a company is added to the portfolio or removed from it. Some companies seem to remain quite constant from year to year – UPS and Intel are good examples of companies that have received high marks consistently. Other company scores move up or down based on all sorts of factors – changes in leadership, corporate practices or behavior, such as how a company handles a crisis or decline in business, or new information that’s publicly come to light, such as corporate actions that generated fines or other sanctions from a government regulatory body.

Second, because we work to ensure representation across all broad economic sectors, how a company’s scores compare to those of other companies in its industry can also be an important factor. So one company might hold steady, but if it’s passed by a competitor that’s doing new, great things that are improving its scores, the original company might fall out of the portfolio. Similarly, some companies might move up if a company or two above them takes a tumble in scores.

Q: How do you account for ‘good’ companies in bad sectors, like energy companies, or good companies moving from growth stock status to value status, such as Apple?

A: As I mentioned earlier, we try to ensure that the index has some representation from all major economic sectors, so we do seek to find companies that have better employer/seller/steward scores than their peers within their own industry. At the same time, we’ve designed the index to be able to have higher relative weights in those sectors where there tend to be more companies with higher scores, so we do have some representation in lower-scoring sectors, but not as much as we have in higher-scoring sectors.

On your second question, we focus more on a company’s fundamentals – in our case, their employer, seller and steward scores – and don’t really look much at whether a stock is considered to be a growth stock or value stock. So Apple would be evaluated exactly the same way today as it was a few years ago.

Q: How did the ECSI fair versus other indices during the recent correction?

A: The ECSI fared well when the market tumbled in the late summer and fall of 2015, then lost a bit of its advantage relative to the market earlier this year when the market fell again. Over the last couple of months, however, it’s rebounded quite nicely and now has a larger advantage relative to the market than it had when the correction began.

Q: What have you personally learned from this exercise so far?

A: I’d say we’ve learned three primary things. First, as we work to calculate company-level scores each year, we get a good sense of trends in all sorts of areas related to our primary company categories of employer, seller and steward. The one trend that has really jumped out at us over the last couple of years has been the increase in penalties and fines assessed against large U.S. corporations. At some level, this has to reflect an increasing intolerance on the part of the public for corporate bad behavior.

Second, we’ve been struck the portfolio’s consistent market outperformance over time. Going in, we believed strongly that there were many reasons that good employers, sellers and stewards should outperform their business competitors. To see it actually reflected in dollars and cents in the stock market, however, has been an important discovery. It’s concrete evidence that these factors really do matter.

And finally, every year it seems there’s more data available for us to consider. More and more people are tracking one or another element of a company’s behavior, which has been a positive development for purposes of enabling investors to know about previously unconsidered factors that have an impact on a company’s stock performance.

Q: What kinds of changes would you anticipate when the Index is changed again in September?

A: I’d expect that we would once again turn over about 30% or 40% of the portfolio, since that seems to have been the norm in recent years. That turnover is based on some of the factors and changes I mentioned earlier. It’s hard to point to more specific changes, since we really won’t know until we’ve collected all the data. Every year there are some surprises, with some previous stalwarts being replaced and some new companies nosing their way into the portfolio for the first time. It’s always fun to see what changes take place – and just as much fun to see who’s staying in the portfolio for another year!

The 2016 ECSI Portfolio

- Agilent Technologies

- Alcoa

- Allstate

- Applied Materials

- Boston Scientific

- Bristol-Myers Squibb

- Campbell Soup

- CenterPoint Energy

- Cisco Systems

- Clorox

- Cognizant Technical Solutions

- Colgate-Palmolive

- Costco

- CSX

- Cummins

- Dominion Resources

- DTE Energy

- Ecolab

- Eli Lilly

- EMC

- Estee Launder

- Exelon

- Fluor

- General Mills

- Hershey

- Hess

- Humana

- Intel

- Johnson and Johnson

- L Brands

- Marriott International

- Nike

- Nordstrom

- PepsiCo

- PPL

- Principal Financial

- Prudential Financial

- Qualcomm

- Rockwell Automation

- Southwest Airlines

- UPS

- Whirlpool

- Whole Foods Market