The Real Social Responsibility of Business: Create and Retain Customers, Profits Will Follow

This article is based in part on an Enterprise Engagement Alliance YouTube show on stakeholder management with R. Edward-Freeman, Professor of Business Administration at the Darden School at the University of Virginia, and Gary Rhoads, Professor Emeritus of Marketing and Entrepreneurship at the Marriott School at Brigham Young University. Freeman wrote the 1984 book Strategic Management: A Stakeholder Approach. Rhoads was a consultant to the Enterprise Engagement Alliance's Enterprise Engagement: The Roadmap.

This article is based in part on an Enterprise Engagement Alliance YouTube show on stakeholder management with R. Edward-Freeman, Professor of Business Administration at the Darden School at the University of Virginia, and Gary Rhoads, Professor Emeritus of Marketing and Entrepreneurship at the Marriott School at Brigham Young University. Freeman wrote the 1984 book Strategic Management: A Stakeholder Approach. Rhoads was a consultant to the Enterprise Engagement Alliance's Enterprise Engagement: The Roadmap.By Bruce Bolger

Customers, Employees, Distribution, Supply Chain Partners Create the Value, Investors Finance It

Short-Term Thinking Can Destroy Long-Term Value

There is a Better Way: Focus on Attracting and Retaining Customers

Shareholder Capitalists Have Overlooked a Key Aspect of Friedman’s Thinking

Profits Are Essential, But They Are the Outcome of Attracting and Retaining Customers, Not Investors

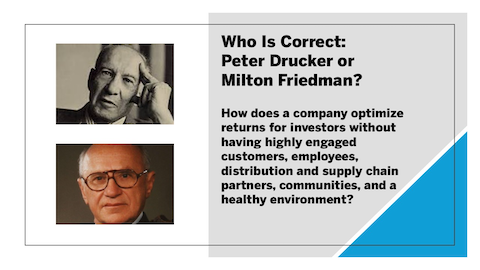

In 2025, it's time to abandon the notion that the social responsibility of a company is to increase its profits. Instead, the purpose is to create and retain customers and the employees, distribution and supply chain partners, and communities needed to engage them so that the company produces the profits needed to fund growth and reward investors.

In 2025, it's time to abandon the notion that the social responsibility of a company is to increase its profits. Instead, the purpose is to create and retain customers and the employees, distribution and supply chain partners, and communities needed to engage them so that the company produces the profits needed to fund growth and reward investors.In 1970, the economist Milton Friedman argued in the New York Times magazine that “the social responsibility of business is to increase its profits.” More than fifty years later, his misunderstood doctrine is as out of step with reality as it is damaging to society. The unfettered pursuit of profit has created a staggering level of income inequality and tremendous waste to shareholders and dissatisfaction to customers and employees.

Well before Milton Friedman, Peter Drucker, one of the first modern management consultants, had another view: “There is only one valid definition of business purpose: to create a customer.” A customer, he says, is someone whose needs the business aims to satisfy to create profits. The customer determines what a business is, what it produces, and whether it will succeed and generate a profit. Without employees, distribution and supply chain partners, and healthy communities highly engaged in the mission, it’s unlikely that an organization can optimize customer engagement.

Friedman’s focus on profits, conveniently taken out of context, has helped cement a doctrine of shareholder primacy that still shapes business schools, boardrooms, and Wall Street today. What many shareholder-focused businesses appear to have overlooked was Friedman’s caveat about the pursuit of profit: “So long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.” Most would agree that many business actors fail to meet these standards in their marketing or business practices.

The truth is obvious: profit is not a company’s purpose. Profit is the result of fulfilling the organization’s purpose to serve and retain customers. Like red blood cells to the body, profits are necessary, but no one believes the purpose of life is to produce more blood cells, any more than it is possible to optimize profits in the absence of engaged customers. A healthy body requires oxygen, nutrition, relationships, and meaning—just as a healthy business requires customers and employees, distribution and supply chain partners, and relevant communities, ideally working toward a common purpose, goals, objectives, and values driven by customer needs.

Customers, Employees, Distribution, Supply Chain Partners Create the Value, Investors Finance It

Friedman’s narrow focus on profit maximization ignores the way businesses operate as defined much earlier by Drucker, who knew that without customers and other stakeholders, profits could not exist. The unfettered application of Friedman’s thinking has systematically extracted value from customers, employees, distribution and supply chain partners, communities, and the earth. No company can succeed for long by serving shareholders alone. The most successful organizations build products customers want, create workplaces where employees thrive, treat suppliers fairly, maintain trust in their communities, and don’t offload costs on to society through pollution or abandoned facilities. The most successful entrepreneurs and executives know this instinctively: they don’t wake up thinking about quarterly earnings per share, they wake up thinking about solving problems and creating value for customers.

Short-Term Thinking Can Destroy Long-Term Value

Ironically, a relentless focus on short-term profits often destroys long-term value. Companies routinely invest heavily for years without turning a profit—think Amazon, Nvidia, ASML, Tesla, or biotech innovators—because fulfilling a larger purpose requires patience and vision. If their leaders had blindly followed Friedman’s maxim, those companies might never have survived long enough to transform their industries.

Even worse, extracting wealth without growing the pie has helped produce today’s record levels of income inequality, workforce disengagement, and public mistrust of business. The costs to shareholders of this approach are staggering: nearly $500 billion in lost US productivity, according to Gallup, not to mention low levels of employee and customer engagement, fragile supply chains, and communities left behind,

There is a Better Way: Focus on Attracting and Retaining Customers

A focus on harmonizing the interests of all stakeholders toward a clear purpose, goals, objectives, and values to create and retain customers. Decades ago, Professor R. Edward Freeman at the Darden School at the University of Virginia articulated a framework for “stakeholder theory,” which holds that companies create durable value only by addressing the needs of all who depend on them—customers, employees, suppliers, communities, and investors. His work, and that of many others, shows that aligning these interests is not only ethical but practical. Today, well-known examples include Costco, Wegman's, Whole Foods, Delta Airlines, Nucor Steel, and many others who almost never brag about because it's just better business.

Companies with engaged employees also have more engaged customers. Firms that respect suppliers are more resilient. Communities that trust a company are more likely to welcome its growth. The connection between having highly engaged employees and enhanced share prices most recently has been confirmed by Irrational Capital, whose Human Capital Factor has demonstrated annual future equity value creation of 4% per year compounded.

Shareholder Capitalists Have Overlooked a Key Aspect of Friedman’s Thinking

His belief that taking care of stakeholders is so vitally contributes to profits that companies shouldn’t use such practices as a source of virtue signaling. “Of course, in practice the doctrine of social responsibility is frequently a cloak for actions that are justified on other grounds rather than a reason for those actions. To illustrate, it may well be in the long‐run interest of a corporation that is a major employer in a small community to devote resources to providing amenities to that community or to improving its government. That may make it easier to attract desirable employees, it may reduce the wage bill or lessen losses from pilferage and sabotage or have other worthwhile effects. Or it may be that, given the laws about the deductibility of corporate charitable contributions, the stockholders can contribute more to charities they favor by having the corporation make the gift than by doing it themselves, since they can in that way contribute an amount that would otherwise have been paid as corporate taxes.”

Profits Are Essential, But They Are the Outcome of Attracting and Retaining Customers, Not Investors

Stakeholder capitalism is not charity, nor is it “virtue-signaling” as Friedman correctly anticipated. It is common sense. Profits remain essential, but they are the outcome of attracting and retaining customers by effectively serving their interests. Businesses that embed customer-focused purpose into their cultures and operations have a greater likelihood of building stronger brands, more loyal customers, workforces, and greater investor returns over time.

The misinterpretation of Friedman’s work may have made sense in an era when business was more insulated from global interdependence and social scrutiny. But in today’s interconnected economy, where reputation, engagement, and trust are as vital as capital, clinging to shareholder primacy is not only outdated—it is self-defeating.

The responsibility of business is not simply to make a profit. It is to fulfill its purpose in a way that creates value for all stakeholders. Create and retain customers, and profit will follow, as surely as blood flows through the veins of a healthy body.