The Economics of Engagement

In today's economic environment, employers are struggling to find every advantage possible to thrive, grow or simply to stay in business. For most US based organizations payroll represents the largest expense. Advantages therefore, come first and foremost through better talent management.

| Introduction | Conclusions |

| What Is “Employee Engagement”? | Acknowledgements |

| The Evidence For Engagement: Research & Case Studies | |

| Measuring the Returns On Engagement |

By Allan Schweyer, Human Capital Institute

Published by: Human Capital Institute

Click here to view and download a PDF of this page.

Introduction

In today’s economic environment, employers are struggling to find every advantage possible to thrive, grow or simply to stay in business. For most US based organizations payroll represents the largest expense. Advantages therefore, come first and foremost through better talent management.

Talent management describes a wide range of activities, and not all positive. Most employers have already frozen or restrained hiring and many have downsized their workforce. While both are at times necessary, it is our contention that the largest opportunity for corporate performance improvement lies in engaging the workforce to drive better customer engagement, better revenue and higher profits. Employers that can improve employee engagement during the downturn will reap immediate and longterm benefits (Return on Investment) as described in this paper.

The Cost of Employee Disengagement

The cost of employee disengagement is profound. In the aggregate, employee disengagement is estimated to cost the US economy as much as 350 billion dollars per year in lost productivity, accidents, theft and turnover1. For organizations, the difference between an engaged and disengaged workforce can ultimately mean success or failure. At the individual level, engagement at work influences all aspects of an employee’s life and those that are close to him or her. It is no stretch to say that the economy (and therefore the nation as a whole) businesses and society have an equal stake in ensuring that the American worker is engaged at the highest levels possible.

Most leaders and organizations know the difference between a fully engaged worker and one that is marginally engaged or disengaged. The former brim with enthusiasm, they contribute ideas, are optimistic about the company and its future, are seldom absent from work, they typically stay with the organization longer and are among the organization’s most valuable ambassadors.

Disengaged workers, on the other hand, are often absent (even when they are at work). They are disconnected and often pessimistic about change and new ideas. They have high rates of absenteeism and tend to negatively influence those around them, including potential customers and new hires.

Disengaged workers cost organizations money in many ways. The most important difference between engaged and disengaged workers, however, is productivity. Engaged and disengaged workers of equal skills, knowledge and abilities do not contribute equally. Engaged workers are significantly more productive. Moreover, where they interact with customers, they are much more likely to create relationships that generate loyalty and increased business. And when they interact with other employees or prospective employees, they are more likely to convey enthusiasm and a positive message about the organization.

While experienced managers wouldn’t argue with the above, there unfortunately exist few measures that quantify the impact of engagement in financially tangible terms. This paper describes and classifies the best measures that do exist, along with Return on Investment (ROI) methodologies that impact intangibles (such as turnover) but can be measured and therefore contribute to a quantifiable understanding of the benefits of employee engagement. These measures are important because initiatives designed to drive engagement are often time and resource intensive and while we may firmly believe that they are worth the investment, we must also strive to demonstrate that potential in terms that senior executives and investors can quantify to the bottom line success of the company.

What Is “Employee Engagement”?

Employee engagement is the level of commitment and involvement an employee has towards their organization and its values (Vazirani, 2007). Engagement is the willingness and ability to contribute to company success, the extent to which employees put discretionary effort into their work, in the form of extra time, brainpower and energy (Towers Perrin, 2007). Often used as a synonym for motivation or motivation and retention; engagement is really more fundamental. Engagement is an employee’s decision to apply his discretionary effort to the goals of the enterprise, to accept those goals as his own and wholeheartedly commit himself to achieving them. (Fineman & Carter 2007)

There are many definitions of employee engagement but it boils down to the extra an employee is willing to give based on their emotional commitment to the organization. Sadly, it appears that most American workers have not made this connection with their employer. According to a 2008 study by Gallup, about 54 percent of employees in the United States are not engaged and 17 percent are disengaged. Only 29 percent are engaged. In December 2008, Towers Perrin’s Global Workforce Study of almost 100,000 employees in 20 countries found that only 22% of the US workforce is engaged, 66% not engaged and 11% disengaged.

We have discussed engaged and disengaged workers but what is a “not-engaged” worker? These employees occupy the middle ground and are normally the majority in most organizations. They tend to concentrate on tasks rather than the goals and outcomes they are expected to accomplish. They often want to be told what to do just so they can do it and say they have finished. They focus on accomplishing tasks vs. achieving an outcome. Employees who are not-engaged tend to feel their contributions are being overlooked, and their potential is not being tapped. They often feel this way because they don't have productive relationships with their managers or with their coworkers.

In our assessment, there also exists another category of workers, the “actively disengaged.” Though a small minority (because they typically leave voluntarily) while they are in the organization, they can do tremendous damage. They are often disruptive and negative toward the organization and its mission. They're not just unhappy at work; they're busy acting out their unhappiness. They sow seeds of negativity at every opportunity. Every day, actively disengaged workers undermine what their engaged coworkers accomplish. As workers increasingly rely on each other to generate products and services, the problems and tensions that are fostered by actively disengaged workers can cause great damage to an organization's functioning. If an organization cannot change these employees quickly, they should terminate them. Some actively disengaged workers have no intention of leaving voluntarily, in effect, they “quit and stay”.

And so it is clear that organizations must know who their engaged, not-engaged disengaged and actively disengaged employees are so that they can take action to move employees up the engagement ladder or out of the organization. How this is done is critically important but first, we still need to explore why? As above, experienced managers know that employee engagement is important but they should also be able to quantify its benefits and quantify the damage done by disengaged and actively disengaged employees.

Measures of the Economic Impact of Engagement

Engaged employees work smarter, not harder. They look for ways to improve performance and they find them. This means more sales, lower costs, better quality and innovative products. Engaged employees communicate – they share information with colleagues, they pass on ideas, suggestions and advice and they speak up for the organization. This leads to better performance, greater innovation and happier customers. Engaged employees go out of their way to meet customers’ needs. Customers aren’t slow to notice and this leads to higher levels of repeat business, at a lower cost to the business than that of acquiring a new customer.

However, it is one thing to make statements and another to prove them. Although laboratory-style causal proof isn’t possible in the social science and art of talent management, irrefutable evidence of the link between employee engagement and better performance – individual, team and organization – abounds.

The Evidence For Engagement: Research & Case Studies

“Research has clearly and consistently proved the direct link between employee engagement, customer satisfaction and revenue growth.”

~ Harvard Business Review, 2000

“Research has shown that engaged employees are more productive employees. The research also proves that engaged employees are more profitable, more customer-focused, safer, and more likely to withstand temptations to leave. Many have long suspected the connection between an employee's level of engagement and the level and quality of his or her performance. Our research has laid the matter to rest.”

Gallup, 2009

In 2005, a milestone book, The Enthusiastic Employee: How Companies Profit by Giving Workers What They Want by Dr David Sirota of Sirota Consulting made headlines across corporate America. Sirota used never before-published case studies, more than 30 years of employee attitude research and data from 920,000 employees from 28 multinational companies over 4 years. This data showed that the share prices of firms with highly engaged employees increased an average of 16 per cent in 2004, compared with an industry average of 6 per cent. Stock prices of companies with high morale outperformed similar companies in the same industries by more than 2½ to 1 during 2004, and the stock prices of companies with low morale lagged behind their industry competitors by almost 5 to 1.

A Towers Perrin study in August 2005 covered 85,000 people employed in large and midsize companies in 16 countries on four continents. It shows that there is a vast reserve of untapped “employee performance potential” that can drive better financial results if companies can successfully tap into this reserve. The study shows that highly engaged workers believe they can and do contribute more directly to business results than less engaged employees. For instance:

- 84% of highly engaged employees believe they can positively impact the quality of their company’s products, compared with 31% of the disengaged.

- 72% of the highly engaged believe they can positively affect customer service, versus 27% of the disengaged.

- 68% of the highly engaged believe they can positively impact costs in their job or unit, versus 19% of the disengaged.

Watson Wyatt researchers quantified this relationship by performing an analysis to explain current financial performance (measured as the market premium) as a function of various factors. They found a significant relationship between current financial performance and past engagement even after controlling for past financial performance, industry and other considerations: A significant (one standard deviation) increase in the level of past employee engagement is associated with a 1.5 percent increase in current market premium, all other factors including past market premium constant. For the typical company in the sample, with a market value of $14 billion, that represents an increase in market value of 1.7 percent or more than $230 million.2

Employee engagement data is today broadly accepted as a leading indicator of performance whereas financial data is a lagging indicator. Thus, applied correctly, engagement data can act as an early warning system, allowing organizations to right the ship before the conditions causing a decline in employee engagement translate into a hit on revenue and profits.

Human Capital Institute/IBM

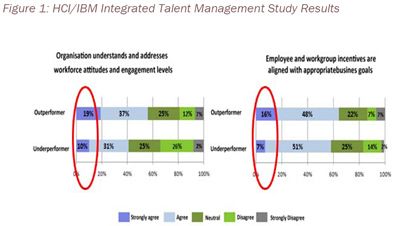

In 2008, the Human Capital Institute and IBM partnered to undertake a large, global research study into the adoption and impact of Integrated Talent Management practices. In part one of our study, we examined the three-year financial track records (2004-2007) of the 287 US publicly-traded companies among the 1900 that responded to our survey.

Across the board, those that invested more in talent management, performed better financially. However, we found that those who were able to do two things in particular - focus on measuring and addressing employee engagement and aligning incentives to business goals - were more likely to out-perform other organizations in their industry than by pursuing any other talent management initiatives (See Figure 1 below).

Stanford University

In 1996, Theresa Welbourne and Alice Andrews published the results of research they had been conducting into the survivability of start-ups for the previous eight years. They analyzed the five-year survival rates of 136 companies that had made initial public offerings in 1988. They found that companies who emphasized the importance of their people, and shared rewards broadly, survived at a much higher rate than those that didn’t.3 Similarly, Blimes, Struven and Wetzker of the Boston Consulting Group conducted research over an eight year span to understand the characteristics of top performing companies (forty-eight in Germany and thirty-six in the U.S.). In every case, each of the high performing companies had unusually progressive policies toward their employees.4

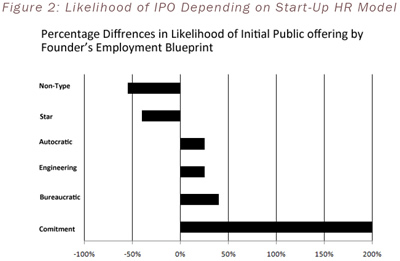

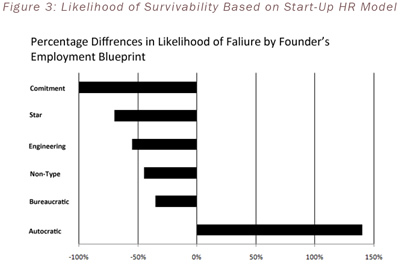

In 1999, Stanford Business School professors Michael T. Hannan and James N. Baron published research they had done on the success rates of Silicon Valley start-ups in the 1990s. In their research, they discovered five models of human resource management (normally driven by the start-up’s founder and/or CEO). These models are: Star, Commitment, Engineering, Autocracy and Bureaucracy. The “Star” model centers on recruitment – get the best people on the bus and they will take you where you need to go. The “Commitment” model emphasizes engagement and a family-like work environment characterized by caring and trust. The “Engineering” model emphasizes performance, challenging work, self-motivation and teamwork. The “Autocratic” model emphasizes top down command and control - “you work, you get paid” and the“Bureaucracy” model emphasizes process, procedure and rigor.

Hannan & Baron found that the Commitment model results in start-ups that are most likely/fastest to go public (see Figure 2 below). All other things being equal, the Commitment firms are also significantly less likely to fail (disappear, de-listing, liquidation– Figure 3 below). And while Star firms have the largest post-IPO increases in market cap, they are followed closely by Commitment firms. Not surprisingly, Autocracy firms perform the worst, followed by firms without a clear model.5

Fortune/Great Places to Work

There are some fundamental conditions that must be in place in order to make employee engagement possible. Whether the engagement diagnostic is from Gallup, Towers Perrin or most any other source, questions about the quality of the employee’s relationship with the organization, supervisors and colleagues are included. From its 2008 global engagement study of 90,000+ workers worldwide, Towers Perrin concluded that, while the impact of the immediate boss on employee engagement is large, the top single driver of discretionary effort is “senior management’s sincere interest in employee well being.” In other words, does senior management consistently demonstrate that it truly cares about front line employees? The Great Place to Work Institute (GPTWI), a San Francisco based organization that produces Fortune Magazine’s “100 Best places To Work” list each year, boils this down to trust. According to them:

“… a great workplace is measured by the quality of three, interconnected relationships that exist there:

- The relationship between employees and management.

- The relationship between employees and their jobs/company.

- The relationship between employees and other employees.”

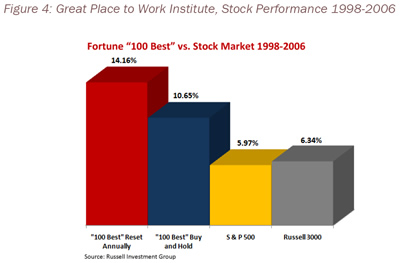

In determining who makes the annual 100 Best places to Work, GPTWI surveys at least 400 individuals from each company nominated each year. The employees rate the organization on elements of trust and workplace relationships, their assessments lead to the final selection of the top 100.

Since 1998, the first year of the Fortune100 Best Places to Work List, and through 2006, the publicly traded organizations on the list have significantly outperformed the average Standard & Poor 500 company and the Russell 3000 index. Indeed, if an investor bought stock only in companies that made the top 100 list from 1998 to 2006, his investment would have been worth more than double an identical investment in the S&P 500 or Russell 3000 companies (see Figure 4 below).

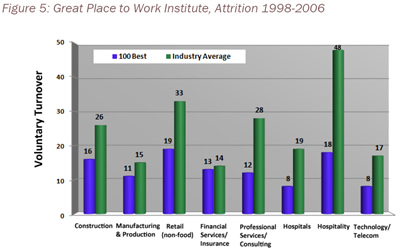

As above, employee engagement in the top 100 companies is high, leading to better performance, sales, customer retention, etc. It is also reflected in turnover data. Per Figure 5 below, over an eight year period, turnover in GPTWI Top 100 companies is mostly much lower than the industry average across a range of sectors. Given the enormous cost of turnover, this is another of the key reasons for better financial performance among the top 100 organizations on Fortune’s annual list.

Costco

As in the GPTWI example above, the fundamentals are fairly basic. Organizations that can establish trust between the workforce and management and between co-workers, stand to earn an engaged workforce and the benefits that go along with it. But how does one build trust? In large part, trust is established by treating employees well and consistently - through good times and bad. In the big box retail sector, competition is fierce and margins are thin, yet Costco CEO Jim Sinegal bucks the low wage, commodity approach to the workforce and for years he has proven that it pays off in many ways.

At Costco, employees have learned to trust that the following will be true, regardless of the business cycle:

- At least $10/hr starting wage (avg. $17/hr - 42% more than Wal-Mart)

- After four years, a cashier earns approximately $44,000, including bonuses

- 94% of health care costs are covered by Costco

- Generous & compassionate family leave policies

- CEO pay vs. avg. employee, 10 times. National Avg. 531 times

The results are eye-popping:

- 23% Turnover vs. 66.1% industry avg.

- 7% labor costs vs. industry avg. of about 16%.

- Sales (2003 through Aug) on 312 U.S. stores: $34.4 B vs. Sam’s Club $32.9 B with 532 U.S. stores: Higher productivity, Higher profitability

- Costco stores generate nearly double the revenue of Sam's Club stores on average ($112 million vs. $63 million) and more per square foot.

- Reduced employee theft: .2% vs. industry avg. 2%

As, Patricia Edwards, managing director of Wentworth Hauser and Violich (a San Francisco investment firm that owns 785,000 shares) says: "These guys have bucked Wall Street as far as taking care of their employees, yet their return last year was pretty darn good." Indeed, in 2003, Costco's sales topped sales at Wal-Mart's Sam's Club by 21%, even though Sam's had 28% more stores. Costco stock was up 34% for calendar 2004; Wal-Mart's stayed about even.6

Jim Sinegal does not pretend that his policies are intended solely for the good of his employees, he contends (and proves) that his policies are a good business investment - that they pay off financially.

Measuring the Returns On Engagement

Evidence abounds demonstrating the importance of employee engagement to the success of modern organizations, the examples above are only a few of a vast and growing body of case studies and research that make the point convincingly and consistently across all industries and countries. But employee engagement related initiatives are expensive and all encompassing. The initial capital outlay to start the initiatives may be modest, but to change or improve an organization’s culture so that employees better trust their leaders, so that leaders are instilled with a talent mindset and commit themselves to the daily practices of coaching, rewarding, managing performance and talent planning, is a long endeavor requiring patience, perseverance and expense.

As such, convincing the senior leaders in an organization to make employee engagement a priority, is usually difficult. HR leaders must demonstrate the expected Return on Investment (ROI) in a convincing and credible manner. Happily, tools and expertise are available to make the business case for engagement using the bottom-line language that CEOs and CFOs understand. The following are examples of the latest tools and techniques in Engagement ROI and measuring “The Return on Engagement”.

Sears

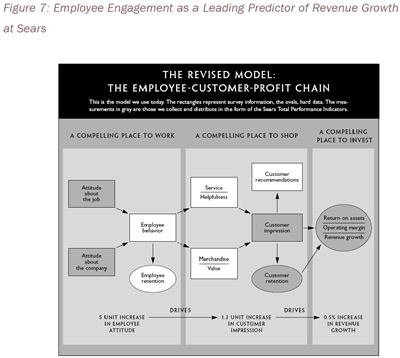

Though the organization has faltered in recent years, Sears was a trailblazer in measuring the “Return on Engagement” (ROE). During the recession of the early 1990s, Sears, at that time the world’s largest retailer, was losing billions of dollars per year. But losses didn’t make the company unique, competitors as well as firms in almost every other industry were also suffering from the recession and mass layoffs were the order of the day. Despite its losses, Sears chose not to downsize. Instead the executives decided to invest more in their workforce, particularly in measures aimed at employee engagement. Sears hypothesized that better employee engagement would lead to better customer engagement, leading to more sales, revenue and profits (See Figure 6 below)

“By enabling employees to see the implications of their actions, it changed the way everyone at Sears thought and acted. The bottom line reflected this changed behavior: the merchandising group, for example, went from a loss of nearly $3 billion in 1992 to a net income of $752 million in 1993.” – Harvard Business Review, December, 2008

On the face of it alone, Sears’ dramatic financial turnaround correlates strongly with their employee engagement initiatives. But Sears went much further. In fact, they came as close to proving the link between employee engagement, customer satisfaction/engagement and profits as any study before or since. Within two years of the launch of the program, Sears was able to use employee engagement data as an almost perfect leading indicator of financial performance in its stores. For example, a store manager whose engagement scores increased by 5 units, could expect a 1.3 unit increase in customer impression (satisfaction) followed by a .5% increase in revenue growth (See Figure 7 below).

Source: Rucci, Kirn, Quinn: “The Employee-Customer Profit Chain at Sears”, HBR, 1998

Gallup: Human Sigma

The work done at Sears has led to similar use and refinements of their toolset in other organizations and is a precursor to research done by Gallup more than a decade later. In HR circles at least, Gallup is best known for its Q12 employee engagement diagnostic. Derived from millions of interviews and extensive data sets, Gallup researchers have boiled the measurement of employee engagement down to just 12 questions. The Q12 is likely the most utilized index of its kind in the world.

More recently, Gallup has introduced a new tool, the CE11, designed to test customer engagement. Taken together, the Q12 and the CE11 form the basis for “Human Sigma”, a measurement of the employee – customer encounter and the subject of a 2007 book (Human Sigma) by Gallup researchers John H. Fleming and Jim Apslund. On page 35, the authors state: “In our own research, we have observed that building a critical mass of engaged employees contributes significantly to the bottom line. In a recent study of 89 companies, we found that the companies that build this critical mass of engagement few earnings per share (EPS) at 2.6 times the rate of companies who do not.”7

Gallup research has regularly added to the evidence linking employee engagement to organizational performance, revenue and profits. It’s most recent work provides evidence of the importance of customer engagement and the link between the two types of engagement. Gallup has shown that “rationally satisfied” customers – those that have no or few complaints behave no differently toward their providers than dissatisfied customers. Yet “emotionally satisfied” customers behave entirely differently. If one pauses to think about it, they will no doubt be surprised to hear that even if they satisfy a customer (good pricing, quality on-time delivery, etc.) he or she is no more likely to reward them with loyalty or more business than a customer who feels let down and disappointed (an unsatisfied customer). On the other hand, Gallup’s research points out that emotionally engaged customers are not only more loyal and spend more, they are far more tolerant of mistakes and minor disappointments than either dissatisfied or rationally satisfied customers.

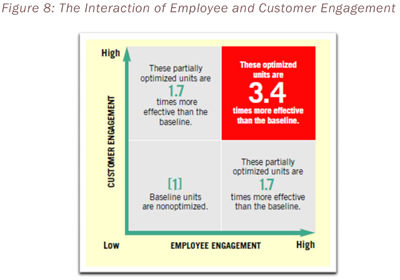

Each of the 10 companies and 1,979 business units Gallup studied as part of its initial Human Sigma research undertook initiatives to strengthen the “employee-customer encounter”, these companies outperformed their five largest peers in 2003 by 26% in gross margins and 85% in sales growth. However, Gallup found that in order for companies to realize outstanding financial benefits, they had to be better than average in both employee and customer engagement (see Figure 8 below).

GALLUP, 2005

Gallup’s Fleming and Apslund argue that engagement, whether employee or customer, is highly local. In other words, variation from store to store (in the case of a retailer, for example) can swing wildly such that an employer might be a “Best place to Work” in Phoenix and a miserable employer in Boston. Customers might be engaged and loyal in Denver but fleeing in droves in Chicago. Not surprisingly, they argue that both forms of engagement must be locally driven and managers held accountable at the most local levels possible.

Gallup has introduced a formula to calculate what it calls an organization’s “Human Sigma” (HS) score. The formula takes each business unit’s mean scores on the G12 and CE11 and turns them into percentages. Then, depending on whether they are above the organization’s median score (50) or below it, the HS score is calculated as follows:

If employee engagement percentile and customer engagement percentile are both above 50, then:

![]()

If either employee engagement percentile or customer engagement percentile is less than or equal to 50, then:

![]()

Most HR leaders will require assistance in using these formulas but to simplify, Gallup uses the results to place their clients in one of six HS bands, one through 6. At the higher ends, HS5 and HS6, business units within organizations have managed to optimize employee engagement and customer engagement leading to “financial results that are about 3.5 times as good as HS1 and HS2 unit’s results.”8

With Human Sigma, Gallup has shone more light on the critical links between employee and customer engagement, demonstrating that initiatives designed only to drive high employee engagement can be too inwardly focused and despite happy employees, they can still fail to engage customers. On the other hand, organizations that focus only their customers may succeed temporarily, but the results cannot be sustainable unless employees are also engaged.

The Center For Talent Solutions

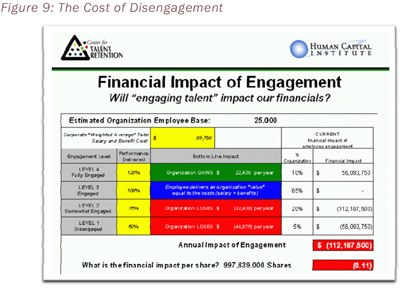

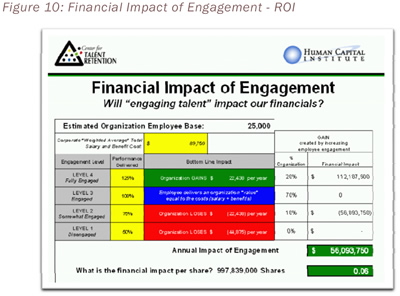

The Center for Talent Solutions - CTS (formerly “Center for Talent Retention”) has added to the quantification of engagement in a different and equally important manner. For nearly the past decade, CTS has been working with firms around the world to increase the engagement levels of their employees. In this time, it has amassed much valuable data on the measures of engagement and, more importantly, the costs versus the benefits of improved employee engagement. Over the years, CTS has found that employees it calls “fully engaged”, deliver, on average, 22% better performance than normally engaged employees. Employees it calls “somewhat engaged” are, on average, only about 75% as productive as normally engaged employees and those it terms “disengaged employees” perform at only about half the value of normally engaged employees.

The example below in Figure 9 shows an organization before specific engagement related activities have begun. In this case, 10 percent of the company is fully engaged and 65 percent are normally engaged, leaving 20 percent only somewhat engaged and 5 percent disengaged. Based on this organization’s performance management data, fully engaged workers are estimated to deliver 25% higher levels of productivity than engaged workers. The somewhat engaged and disengaged are at minus 25 percent and minus 50 percent respectively. CTS estimates that this organization was losing over $112,000,000 annually due to its less than engaged workers (Figure 9 below).

The organization’s next step was to determine specific actions that would lead to better engagement levels. An employee questionnaire was used to better understand where they believed problem resolution or improvements were most necessary. The organization then undertook the actions, assigning clear responsibility and scheduling weekly meetings to discuss the actions taken and the outcomes to date. Managers were held accountable and were under pressure to have something to report at weekly meetings. In the case of the organization profiled above, within seven months, the “fully engaged” doubled to 20 percent, the normally engaged moved from 65 to 70 percent of the workforce and the somewhat engaged and disengaged were reduced by 50 percent and 100 percent respectively. The organization was able to turn its $112,000,000 loss into a $56,000,000 gain (see Figure 10 below).

By using sound methods to calculate the financial costs of disengagement and the financial ROI on improving employee engagement, CTS is able to make a clear business case for investment. The costs and potential rewards are significant from a hard dollar perspective and potentially even greater if the intangible impact of a disengaged workforce could be better calculated. Nonetheless, organizations will need to estimate the costs of the various initiatives they choose to bolster engagement, the good news is that these costs are likely to be dwarfed by the expected returns.

Conclusions

Intuitively, good managers have understood the powerful Returns on Employee Engagement for decades. More recently, research results that quantify those returns have been available to leaders. Today, valid tools exist to measure and predict the ROI in engagement related initiatives. Yet, as Gallup, Towers Perrin and others point out in their studies year after year, the American workforce remains a place where less than one-third of employees can be truly described as “engaged”.

As Gallup points out, the cost of disengagement is enormous – hundreds of billions of dollars are lost in the US economy alone each year. So why don’t more organizations do something about it, particularly now when every dollar counts?

Employee engagement and customer engagement are both driven by the fundamentals in organizations. For both levels to be high and stay high, an organization needs a solid culture and value system that supports the ingredients necessary for engagement. Senior leaders have to drive the process, “walk the halls” to demonstrate their commitment to employee engagement. Managers must be selected and developed with employee (and customer) engagement in mind and they must be held accountable, trough a total rewards and performance management strategy that aligns their desired behaviors, goals and outcomes with those of the organization. Employees must also be made partners in the effort. As in the Sears example, “By enabling employees to see the implications of their actions, it changed the way everyone at Sears thought and acted.”

In most organizations, both the challenges of engagement and the remedies to improve it are daunting. But the payoff is enormous, and beyond the bottom line, it is arguable that in the near future, post-recession, beyond the baby-boomer retirements and after the number of companies investing in engagement reaches a tipping point - an engaged workforce will be a matter of survival. After all, who would continue to drag themselves into work every day for a paycheck when they can have the paycheck and be highly engaged in their work at the same time?

Acknowledgements

Enterprise Engagement Alliance Founders

![]()

![]()

Enterprise Engagement Alliance Leaders

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

1 Human Resources Magazine (Australia), April 2005. “Employee Disengagement Costs $31.5 billion”. By Craig Donaldson

2 Increasing Employee Engagement: Strategies for Enhancing Business and Individual Performance 2007 / 2008 WorkAsia™ Survey Report, Watson Wyatt

3 Theresa Welbourne and AliceAndrews, “Predicting Performance of Initial Public Offering Firms: Should Human Resources Management Be in the Equation?” Academy of Management Journal 39 (August 1996): 891- 919

4 Linda Bilmes, Konrad Wetzker and Pascal Xhonneux, “Value in Human Resources”, Financial Times, February 10, 1997

5 M. Hannan, J. Baron, G. Hsu, and O. Kocak, "Staying the Course: Early Organization Building and the Success of High-Technology Firms," Paper prepared for presentation at HBS 2000 Entrepreneurship Conference, “The Entrepreneurial Process: Research Perspectives,”

6 Inc Magazine, April 5, 2005 (http://www.inc.com/magazine/20050401/26-sinegal.html)

7 Human Sigma, pp35. Fleming and Apslund, 2007

8 John H. Fleming and Jim Apslund, “Human Sigma”. Gallup, Inc. 2007. p.210