Measuring Enterprise Engagement and Performance

| Measure – Analyze – Report – Take Action | Use of Technology |

| Best Practices in Effective Measurement | Conclusions |

| Calculating the ROI of Engagement Initiatives |

There’s a reason for the old adage: “You can’t manage what you don’t measure.” Anyone who has ever tried to run a business knows that’s true. But it is also true that you can’t manage what you measure only once each year.

When it comes to employee and customer engagement, most of us collect information through annual surveys, analyze the results, share them in a high-level report and perhaps devote part of an executive meeting to discuss the implications. Like performance reviews, this is usually done once a year – if at all.

Engagement, however, fluctuates day to day and week to week. Employees and customers, like our suppliers and partners, are complex and unique human beings. Measuring their engagement once a year – though better than nothing – is like getting an annual weather report. It provides a snapshot, but the data is insufficient on which to base critical decisions.

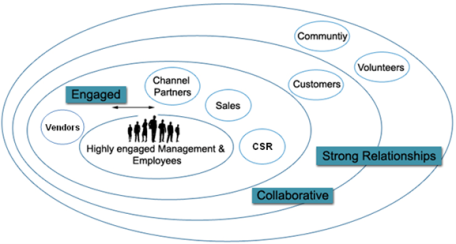

Remember also that your broader constituency – the key groups you depend on for success – include your employees, suppliers, channel partners, customers and to some extent the communities you do business in. (Figure 1).

Figure 1: Enterprise Engagement

When an organization strives simultaneously for better engagement across all of its key constituents, truly exponential gains can be achieved (see “Human Sigma” by Gallup for a detailed explanation). So how can you effectively measure and demonstrate these gains?

Measure – Analyze – Report – Take Action

In order to make informed decisions based in fact, managers need to:

- Regularly monitor trends in employee, customer, supplier and partner engagement

- Analyze those trends

- Share the information across the organization

- Set goals

- Mobilize executives, managers and supervisors to take action

A manager’s incentive plans should be aligned to the achievement of engagement goals. Taking action normally means devising and implementing initiatives aimed at improving one or more areas of engagement.

Best Practices in Effective Measurement

Effective measurement requires that certain fundamentals or principals be observed. Meaningful measurement will normally require an estimate of business impact at minimum and, in some cases, a Return on Investment (ROI) calculation. Following the advice below will ensure that you develop credible and defensible estimates of the business impact and ROI (where necessary) of your engagement initiatives.

1. Baseline data: To measure performance change, there must be meaningful before and after comparators. For engagement metrics, this means having or creating a reliable benchmark before you begin your initiatives. In most cases, the benchmark data will come from your first or previous engagement surveys, or from performance data you have accumulated from a previous, comparable period.

2. Number and “ease” of measures: The number of performance measures should be limited and their tracking not overly complex. For example, employee engagement, customer engagement or channel partner engagement scores are singular measures. More granular measures might include scores by division or even by team and manager.

3. Involvement: It is important to gain participants’ input and feedback in the development of the measures. Off-the-shelf engagement surveys are readily available for employee and customer surveys. The Enterprise Engagement Alliance (EEA) offers its Enterprise Engagement Benchmark Indicator (EEBI), which includes measures for employee, customer, channel partner and supplier engagement. In using these tools for measurement, be sure to collaborate with your constituents in explaining how you will measure progress and what you intend to do with the data. Encourage their input and suggestions, especially in the collection of data and dissemination of results. Another option is to get input from some of the participants via a “nominal group technique.” Using this method, a facilitator works with selected representatives from the people you’re measuring to identify their views related to the most effective performance measures or related opportunities or obstacles. You can also use this phase to help identify any outside issues that could affect results. (See Causality, below.)

4. Conservative financial assumptions: Though difficult, you must place a value on the unit measure of performance or engagement. In doing so, err on the conservative side when making financial assumptions and confirm all financials (assumptions and numbers) with colleagues in the finance department. Calculating financial ROI from intangible benefits such as increased engagement is an imperfect science. By making conservative estimates and by assigning only a portion of the gains to your engagement initiatives, your results are more likely to be considered credible by the CFO. (See ROI calculation section below.)

5. Causality: You may see positive results from your engagement or performance initiatives such that even conservative estimates of the dollar value appear quite high, especially when all of the gains (in sales, for example) are attributed to your engagement initiatives. The impact of your initiatives take time to surface, so you must consider external influences that might be partially responsible for the gains (or losses, as the case may be). If your sales team engagement initiative occurred between January and March, for example, you might have had to wait until October for sufficient data to measure its impact. In between, the economy might have changed, demand may have increased or the competition may have suffered a setback. These influences have to be considered and factored into your equations. One means to limit the effect of external influences is frequent measurement. For example, suppose you’ve held an event for channel partners. You measure its impact at the time of the event (reaction), then a month or two later (application), and then again after six months or so to determine the business impact and ROI (i.e., greater sales). Still, if prices of products have changed during those six months or if demand has changed, consider these factors in determining causality.

6. Linkage: Measures should ideally be linked to organizational goals and geared to driving organizational success. When developing your measurement plan, always think about corporate objectives and strategy. For example, one of the organization’s goals may be to earn more “share of spend” from existing customers. In this case, correlate customer engagement measures to the metrics being gathered on share of spend. Did an initiative drive better customer engagement scores? Did better customer engagement result in more share of spend?

7. Demonstrating ROI: The financial impact of poor engagement, or conversely, the opportunity for significant financial gain where engagement is improved, is often large enough to warrant a measurement strategy that goes all the way to an ROI calculation. Where this is the case, measures and metrics chosen must support the calculation of ROI. (See next section.)

8. Targeting: Select high impact metrics to demonstrate that scarce resources are being applied in such a way as to maximize business impact and ROI. For example, metrics aimed at tracking sales increases or reducing customer attrition are ideal. Both are easy to convert to dollar values in a credible manner and both are easily understood, high impact measures.

9. Ongoing monitoring and feedback: As referenced in Point 5, effective measurement provides not only the opportunity to track your engagement efforts at the end of a program period, but also along the way. Make sure you build into your measurement effort a means to collect and analyze information on a regular basis and make adjustments accordingly to your strategy and tactics to address performance or engagement gaps.

10. Predictive analysis: In making the case for spending money on engagement initiatives, a predictive analysis of expected ROI can be very useful. Metrics need to support management‘s ability to understand the relationship between improvements in the measure and impact on organizational success (i.e., if goals are achieved, what is the value to the organization versus the cost?).

Calculating the ROI of Engagement Initiatives

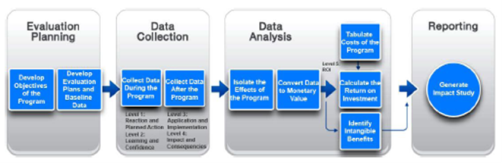

The best known, widest implemented and most successful method for measuring the impact and ROI of business initiatives is the ROI Methodology™ developed in the 1970’s by Dr. Jack Phillips. Figure 2 below illustrates the key components of the process.

Figure 2: The ROI Methodology

By applying the principles of measurement and using the ROI Methodology™, organizations can effectively measure engagement initiatives. The key steps are as follows:

1. First determine the goals and objectives of your engagement program and ensure that they’re aligned to corporate strategy and objectives. This can include goals related to improving engagement scores by a certain amount, as well as to payoff goals that are tied to ROI, such as a goal to increase customer retention by 10%.

2. Next, create a plan to both collect your data and evaluate it. At this stage you must also have baseline data for comparison. Before moving on, you should be able to identify: a) The data you are collecting b) How you will collect it c) The method(s) you will use for analysis and evaluation d) What you will compare the data to for benchmarking purposes

3. At this stage the program (initiatives) are underway. You might, for example, be seeking an improvement in employee engagement among your consulting group. Your initiative may be manager/supervisor training for those who lead the consultants, for example. In this case, you will collect data on the managers’ reaction to the training, what they believe they’ve learned and what they plan to do with it. Later, as they go back to work, you’ll collect data on whether they’ve actually applied the learning and taken specific actions to improve engagement among their reports. Depending on the nature of the training, you will collect data on the application of the learning and its impact – perhaps at intervals of several months after the training. This may include the results from an employee engagement survey and its linkage to better, measureable financial goals.

4. Now that you have your data, you must isolate for the effects of your initiatives. For example, you’ve measured the reaction, implementation and impact of the manager training program. Suppose an improvement of 41% has been achieved in the benchmark employee engagement survey (among consultants) over the most current survey period. That’s an impressive gain, but how much of the gain should be attributed to the training? Several months may have passed between the courses and the results from the latest survey.

The easiest and most effective means of determining attribution is to ask. Ask the managers, ask a sampling of the consultants, ask senior managers and executives. Each group should be presented with the summary findings and asked how much of the improvement should be attributed to the initiative. After you’ve received your answer, ask them one more question: “How confident are you in your estimate?” After you’ve consolidated your responses, a simple calculation will determine your attribution level.

For illustration, suppose the individuals you canvass estimate, on average, a 55% attribution level, meaning after considering all the things that occurred between the training initiative and the improved engagement results, they would attribute 55% of the gains to the training. Then suppose they were only, on average, 65% confident in that estimate, after all, many months have passed and a lot has happened at the organization that could have impacted employee engagement. Now you have your data to calculate attributions. It’s time to convert the gains (41% better engagement scores) to money.

5. Conservative estimates are critical, since converting any form of engagement results to money is imprecise and therefore subject to the skepticism of financial executives and the CEO. In this example, consider the impact of employee disengagement. For example, is employee attrition higher among disengaged employees than engaged employees? What is the average cost of replacing an employee, including recruitment, onboarding, training, etc.? Are performance review results better for engaged employees versus less engaged employees? Can you analyze several groups of employees (salespeople, for example) and calculate the difference in productivity and performance between those that are engaged versus disengaged and then extrapolate throughout the organization?

Using measures such as these, it is possible to convert engagement gains into hard dollar equivalents. Suppose your organization is a professional services firm that employs 1,250 people. Among them, the consulting group is 800, with an average of $178,000 in salary and benefits. We will also assume that each consultant generates, on average, $350,000 in gross revenue for the firm. Next, assume that you’ve suffered 50 fewer unwanted departures and benefited from 3.2% higher productivity (based on billing increases adjusted for any changes in fees) on average, across the consulting group based on the 41% improvement in employee engagement. Now, in this highly simplified example, you’re ready to calculate dollar value and attribution levels as follows:

Multiply 50 fewer departures by your organization’s average cost of replacement. Common industry standards range from 100% to 150% salary, but suppose you choose a far more conservative estimate based on hard dollar recruiting and training costs, plus loss of productivity (billings, etc.) while the position was unfilled – say $50,000 per person.

$50,000 x 50 = $2,500,000

Next, estimate the hard dollar impact of 3.2% better productivity for all 800 consultants.

800 x $350,000 x 3.2% = $9,000,000

The subtotals of $2,500,000 + 9,000,000 = $11,500,000.

You already know that attribution is 55%, therefore: $11,500,000 x 55% = $6,325,000.

And you know the confidence level is 65%; as such, your next calculation will be:

$6,325,000 x 65% = $4,111,250

After discounting, your gross Return on Investment is about $4.1 million in round numbers.

6. Now you must calculate the entire, fully loaded costs of your initiative. For example, did you purchase the course? Was it delivered by an external trainer or do you need to calculate total compensation divided by days spent on the training by internal instructors? What were the costs of materials, promotion and communication? Did you account for taking all of the organizations’ managers out of their work for the duration of the course, the value of renting the facility (even if it was onsite in a room that would have otherwise been unused), catering costs, etc.? Try to factor in all costs no matter how small to determine “fully loaded” costs.

7. Finally, calculate the ROI of the engagement initiative by subtracting the fully loaded costs from the hard dollar benefits. For the purposes of this illustration, let’s say the fully loaded costs were $550,000. To arrive at an ROI then:

$4,100,000 - $550,000 = $3,550,000

ROI = $3,550,000 - $550,000 x 100% = 545%

$550,000

The hard dollar ROI from the engagement training initiative can be calculated at 545%, a very good return based on conservative calculations and not including all possible tangible benefits (such as reduced absenteeism, etc.) or intangible benefits such as happier employees who may speak better of the organization to colleagues, customers, friends and family.

Use of Technology

Measurement and analysis are no longer as time consuming and difficult as they once were. With today’s low cost, cloud-based software and enterprise engagement surveys with polling, tracking, analysis and dashboard reporting tools, organizations have the ability to connect daily with their key constituents (employees, customers, suppliers and partners).

Daily interaction through engagement software is designed to be non-intrusive. You can’t survey people every day, but as a result of web-based recognition technology, it has become easier to track the engagement of constituents. It’s possible to track not only their performance, but also their web site visits, including the content viewed, learning, innovation, participation in social networks, etc. Moreover, engagement technologies provide a dashboard of performance on an individual, departmental and enterprise level, and also with respect to individual customers, suppliers and re-sellers.

Allowing employees (and especially partners) to view the progress of their peers toward goals and program utilization connects employees and partners to the brand, the engagement portal and their performance objectives. The key is to build community and share data, not just at an administrative level, but also at the participant level.

Conclusions

The measurement of engagement can’t be based on an annual cycle, but must be an ongoing process. This allows an organization to see the immediate impact of its actions (for example, the effect of a price increase on customer and channel partner engagement) leading to a decision-science that permits better strategy and faster action based on actual data.

Tracking and sharing real-time performance against goals leads to more high-level and front-line leaders taking action. Real data based on business impact and ROI helps your organization identify issues and opportunities. For example, if the data reveals a negative trend in channel partner engagement, tactics to reverse the trend can be implemented, measured (often with ROI calculations) and adjusted quickly until the desired impact is achieved. Whether the tactic is additional training for employees who manage channel partner relationships, a richer incentive program or an event for top performing channel re-sellers, decisions are made in the light of metrics, initiatives are evaluated on data, business impact and even ROI. They are then adjusted, expanded or terminated based on measured, defensible evidence.

Ongoing measurement – where the engagement of key constituents is quantified – can ensure success this year. There is no need to wait months for the next employee or customer engagement survey results or, worse, take a stab in the dark based on a hunch. Because so few organizations are tracking engagement data today, an enormous competitive advantage awaits those that do – particularly those that build it into their day-to-day business platforms.