The Holy Grail of Investing and HR? New Solution Connects Human Capital to Return on Equity

A combination of behavioral science, analytics, and financial acumen has yielded a powerful roadmap for enhancing future equity value. The Human Capital Factor is of benefit not only to investors looking for alpha but to boards and CEOs seeking a logical path to achieving higher levels of future equity value through better people management.

A combination of behavioral science, analytics, and financial acumen has yielded a powerful roadmap for enhancing future equity value. The Human Capital Factor is of benefit not only to investors looking for alpha but to boards and CEOs seeking a logical path to achieving higher levels of future equity value through better people management.Insights for Fund Managers, Investors and Senior Management

The Methodology

Implications for Investors

Implications for Human Resources Management

Future Equity Value Creation

Click here for links to information about EEA engagement solution providers.

A method for predicting the future equity value of an organization based on its management of people, known as the Human Capital Factor, has been verified for the fifth year in a row by the analytics department of J.P. Morgan. This means that companies with effective people management will generate an alpha or enhanced results over what they would have achieved under less effective people management.

According to the J.P. Morgan report published this month, “The HCI (Human Capital Index) exhibits a perfect track record for calendar year performance, outperforming the benchmark in every single year of our sample. While it only did so marginally in three years, the overall performance record for this period is stellar. Even in 2024 year to date, it has managed to outperform a benchmark that has so far returned in excess of 20%...The implication is that since human capital is not accounted for on balance sheets, there exists the opportunity to gain enhanced returns by correctly identifying those companies which have superior human capital.” Note: Irrational Capital says that it does not pay for this yearly analysis.

ESM often writes about investors seeking alpha in organizations with higher levels of stakeholder engagement. What if almost any organization or its clients had a scientifically and statistically significant method of identifying the degree to which employees are enhancing or hindering future equity value of their own organizations; the practices that either are succeeding or falling short; and having such insights for the overall company and within it by location, department, gender and level?

Could the Human Capital Factor be a game-changer not only for investment management and investors but for human resources management by helping to demonstrate once and for all the value effective people management creates for organizations, including sales and non-sales employees.

The company may be the first to prove that human capital data, insights, and specific outcomes can be directly connected to equity value creation.

Click here to view or listen to a recent Enterprise Engagement Alliance Purpose Leadership and Stakeholder Management YouTube show with van Adelsberg and Houlahan on the organization’s story and services.

Insights for Fund Managers, Investors and Senior Management

Irrational Capital says that it provides insights and investable indices to leading financial institutions and investment firms. It is now offering the Human Capital Factor® ratings system to organizations seeking to enhance return on equity through people. In fact, the HCF is based on only one key impact: future equity value--the expected worth of a company's equity at a specific point in the future. The calculation includes forecasted growth, earnings, market conditions, and general business performance. This metric is critical because it is used to help shareholders project the future value of their investment.

The company’s founders believe that the HCF analysis can help management identify the effectiveness of its relationship with its human capital as a whole and by various categories and location. The results do not specifically show how to design, monitor, and enhance specific activities, but rather measures their impact, underlines Houlahan, “We really don’t compete with most of the many human resources tools out there; all we do is help organizations rate the effectiveness of their people management based on the potential for future return on equity.” This in turn should enable management to design more effective human capital management strategies and tactics, the company's founders believe.

Irrational Capital says it has found an answer both for investors and management, backed by compelling validation, with the following implications. Investors have access to three NYSE-listed ETFs detailed below based specifically on human resources management. Fund managers have an additional tool utilizing the HCF Signal product to identify tangible opportunities and risks in the domain of human capital, which appears nowhere on balance sheets, income statements, or profit and loss statements. And, executives across the C-suite and their advisors can now demonstrate the ability to drive tangible value in terms of enhanced future equity value for their organizations as well as how to measure the effectiveness of practices in terms of their impact on future equity value.

The Methodology

Irrational Capital shares its methodology for calculating the HCF on its web site, which far exceeds in detail the available space in this article or even the understanding of most people outside of behavioral analytics and finance. Khuram Chaudhry, Managing Director and Head of European quantitative strategy on J.P. Morgan Securities' global quantitative and derivatives strategy team, provides a summary in an article published earlier this year in Pensions & Investors. “Over the past three years, the global quantitative and derivatives strategy team at J.P. Morgan Securities has analyzed the data behind the Human Capital Factor® (or HCF), an approach developed by investment research firm Irrational Capital that seeks to quantify the link between human capital management and [future] equity performance using a combination of public and private data sources.”

JP Morgan’s quantitative analytics department has produced four detailed research papers on the methodology and results. Chaudhry and his team apparently are impressed enough based on their long-term analysis continue to followthe Human Capital Factor®. Von Adelsberg says this is particularly of note given that there is no formal or business relationship between Irrational Capital and JPM.

In the Pensions and Investors article, Chaudhry explains, “The proprietary pillar of the data is constructed from the analysis of 2.6 million individual responses to human resources surveys, comprising more than 71 million unique survey data points covering over 1,300 publicly traded US companies and spanning the last 15 years. This dataset includes ratings on the usual and easy-to-measure topics such as compensation, benefits, and training, but adds a wide range of far more important and difficult-to-measure characteristics of the employee-employer relationship. The HCF is able to deeply evaluate the human side of the organization, and tangibly measure levels of appreciation, pride and trust and the relationship with one's manager, the sense of psychological safety and more within the organization.”

Further, “The other datasets used in constructing the HCF are derived from public sources that feature company-specific insights. While this dataset is smaller in overall scope (30 million unique data points), it includes coverage of more than 4,200 US companies.” It should be noted that the HCF data set – both the public and proprietary aspects - grow each year, stresses von Adelsberg.

Implications for Investors

Using datasets developed by the company’s behavioral research analysts, Chaudhry explains, “each company's human capital factor score is calculated through an assortment of analytical techniques. The result is a measure of how effectively these organizations treat their team members. This rating is then used as the metric for stock selection. Based on our analysis, the HCF has delivered consistent outperformance. In fact, the HCF portfolio has outperformed the benchmark (MSCI USA index of large and mid-cap stocks) by 4% per annum over the full period of our back tests, which span the last 14 years (2009-2023).” Van Adelsberg notes that these returns are not driven by the “magnificent seven” stocks: Apple, Microsoft, Google parent Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla at the level of the underlying index(es)." Note: The Enterprise Engagement Alliance’s experimental Engaged Company Stock Index composed of publicly held companies with high levels of stakeholder engagement outperformed the S&P 500 over six years from 2012 to 2018 by over 38%.

In addition, Chaudry writes, “a trio of ETFs (exchange-traded funds) built on the human capital factor all bested their respective benchmarks last year. The index underlying the Harbor Human Capital Factor Unconstrained ETF (HAPY) posted a 35.6% gain in 2023, topping the Russell 1000's return of 24.5%; the index tracked by Harbor Human Capital Factor US Large Cap ETF (HAPI) returned 30.7%, which outperformed the S&P 500's 26.3% total return for the year; and the (underlying) index tracked by Harbor Human Capital Factor US Small Cap ETF (HAPS), (the ETF) launched in April 2023, climbed 17.7% through year-end versus 16.9% for the Russell 2000 for the year.” See ESM: EEA YouTube Show—Finding Performance Alpha Through Human Capital, featuring an interview with the CEO of Harbor Capital, Kristof Gleich.

Notably, JP Morgan’s global quantitative and derivatives dtrategy analysts compared the performance of the Human Capital Factor with that of traditional style and factor strategies (value, growth, momentum, quality) for the period of Dec. 31, 2009 to Jan. 31, 2021 and found, “the HCF strictly dominates all styles across all metrics, it has the highest returns, lowest volatility, highest Sharpe Ratio (return on investment compared with risk), highest hit-rate and lowest maximum drawdown (share price decline).”

For fund managers such as Harbor Capital, the advantages are obvious, the founders believe. “We see a major benefit for investors in public funds but also private equity firms and any organization seeking to enhance return on future equity value through people.”

Implications for Human Resources Management

In addition to demonstrating the ability of human resources to make a tangible contribution to future equity value, the framework provides a statistically supported method for developing strategies designed to optimize the Human Capital Factor® not only at the macro level, but also in terms of identifying which key elements of engagement, organizational effectiveness and alignment and more are being understood, analyzed by employee location, group, type, etc. With such data-supported insights, constructive changes seem to be more possible, van Adelsberg observes.

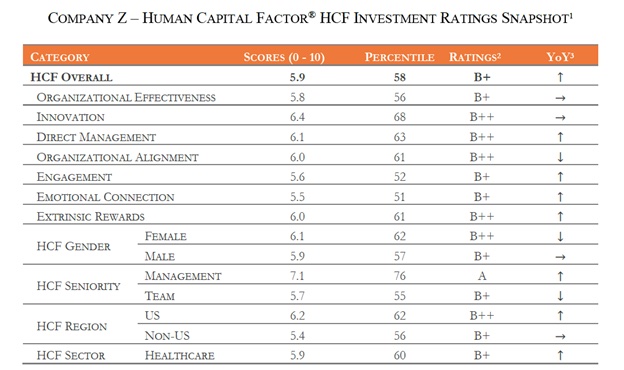

As a result, it seems, after a very long wait, human resource management now has a method of determining the Human Capital Factors® connected to the opportunity to improve future equity performance. Using data from either 1) employee engagement surveys organizations already have in place, or 2) a survey designed specifically to address the Human Capital Factor®, Irrational Capital is offering organizations of almost any size to provide a ratings report that is organized and ranked by each of the seven Human Capital Factor® dimensions in total and by location, department, gender and more. The opportunity, and perhaps the key, is that the company uses this systematic rating system underpinned by up to 17 years of data. The alternative to such a longitudinally rich data set would require years of waiting to ensure statistical significance and confidence.

The elements which are tracked include the seven dimensions mentioned above:

Intrinsic Factors (Those element that are deeply personal, emotional and human and difficult to count.)

- Management (Direct and Senior): mutual respect, confidence, assistance, personal contribution, empathy, personal development.

- Emotional Connection: expectation, confidence, appreciation, purpose/meaning; psychological safety.

- Engagement: Retention, pride,

- Innovation: Diversity of perspective; new ideas,

- Organizational Alignment: values, strategic direction, open communication.

- Organizational Effectiveness: inter-departmental cooperation, quality, respect, potential, psychological safety, positive business outlook, positive culture outlook.

Extrinsic Factors (Those elements which are relatively easy to count)

- The basics: Compensation (level), benefits (level), training hours, physical environment and more.

Click here for a sample HCF report for a fictional company, which includes recommendations based on the findings.

Click here for an RRN article with more details on the implications of the Human Capital Factor for designing more effective people management strategies.

Future Equity Value Creation

Essentially, now, on an annual basis, organizations can use the HCF to point in the direction of potential future equity value based on the perceptions / sentiment of their people.

Over time, organizations can track the relative impact of each of the factors and dimensions to identify areas in which they excel and are optimizing the potential for future equity value and those in which they have opportunity for improvement. This in turn enables them to more effectively develop strategies specifically designed to optimize the key drivers measured in terms of potential incremental contribution or detriment to future equity enhancement.

Executives and managers throughout the organization, including of course, HR management, can use the data and findings of the report to measure the impact of specific strategies and tactics related to specific cohorts of employees and the company overall, according to van Adelsberg.

ESM Is Published by The EEA: Your Source for Effective Stakeholder Management, Engagement, and Reporting

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports professionals, educators, organizations, asset managers, investors, and engagement solution providers seeking a competitive advantage by profiting from a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and ESM media services.

1. Professional Education on Stakeholder Management and Total Rewards

- Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources to master stakeholder management and reporting.

- The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring nine members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

2. Media

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

3. Fully Integrated Business Development for Engagement and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Corporate Sustainability Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.