Can Human Capital Metrics Outperform Managed Investments?

Click here to subscribe to the ESM weekly e-newsletter.

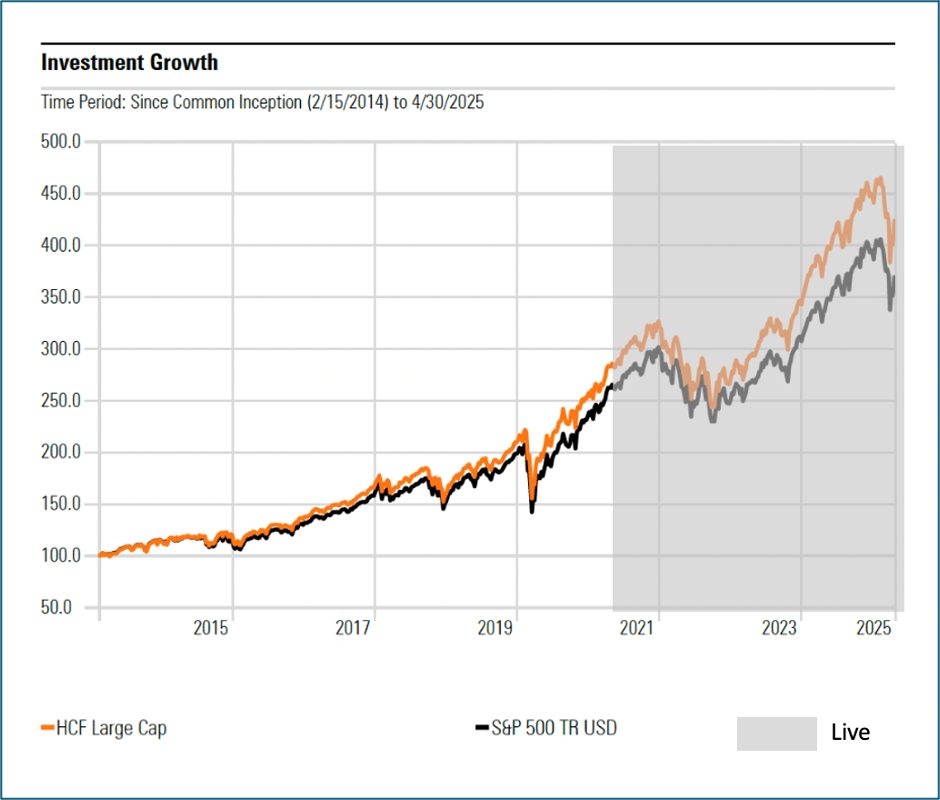

Did you know that most large-cap actively managed funds are consistently outperformed by the S&P 500? According to James Walker, formerly Managing Director and Global Head of Investments for J.P. Morgan Private Bank, and now on the board of Irrational.Capital, the W. Conshohocken, PA-based analytics firm that created the Human Capital Factor, 65% of managers underperformed the S&P 500 over one year; over three years, that figure rose to 85%; and over the full 24-year history of the survey, more than 90% of managers lagged the benchmark. In the meantime, the funds based on the Human Capital Factor have consistently outperformed the S&P 500. See ESM: The Holy Grail of Investing? A New HR Solution Connects Human Capital to Return on Equity.

What if investors could find an investment factor predictive of future value creation more reliable than the typical managed investment fund? “Some companies,” Walker writes, “simply do a better job of building and maintaining relationships with their employees than their peers. In those companies, engagement, motivation, trust, pride, productivity and innovation thrive. While these attributes aren’t captured in traditional financial statements, it stands to reason that if they could be, it would provide forward-thinking portfolio managers a distinct competitive advantage over their peers.”

What if investors could find an investment factor predictive of future value creation more reliable than the typical managed investment fund? “Some companies,” Walker writes, “simply do a better job of building and maintaining relationships with their employees than their peers. In those companies, engagement, motivation, trust, pride, productivity and innovation thrive. While these attributes aren’t captured in traditional financial statements, it stands to reason that if they could be, it would provide forward-thinking portfolio managers a distinct competitive advantage over their peers.”The origins of stock analysis, he writes, go back to the 1934 book Security Analysis, co-authored by Benjamin Graham and David Dodd. “In this book, the authors detail a comprehensive approach to evaluating stocks that focuses on evaluating an array of metrics including liquidity, debt-to-equity, dividend history, price-to-earnings, and price-to-book in order to make informed investment decisions.” He says that Graham and Dodd were not interested in subjective or qualitative judgments, fearing they could lead to inconsistent outcomes. For example, they wrote: “Objective tests of managerial ability are few and far from scientific. In most cases, the investor must rely upon a reputation which may or may not be deserved.’”

Assuming many investment managers follow these principles, they have not demonstrated much value at creating an alpha in portfolio management, based on their results against the S&P 500.

Assuming many investment managers follow these principles, they have not demonstrated much value at creating an alpha in portfolio management, based on their results against the S&P 500.Walker believes “the Human Capital Factor takes the immutable tenets of Graham and Dodd’s approach and updates them for today’s economy. This new investment factor enables investable access to those firms getting the relationships and connections right with their employees. There is now independently verified, statistical evidence that when managers get their most important asset right, their companies are rewarded with enhanced future equity value. And unlike the 85% of managers...the Human Capital Factor has outperformed the S&P 500 every year since its launch in 2020.”

These results, he says, suggest that both the performance and investment flows used to evaluate a company’s prospects for delivering shareholder returns could use a refresh.

Investment managers and securities analysts take note.

Enterprise Engagement Alliance Services

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:1. Information and marketing opportunities on stakeholder management and total rewards:

- ESM Weekly on stakeholder management since 2009. Click here to subscribe; click here for media kit.

- RRN Weekly on total rewards since 1996. Click here to subscribe; click here for media kit.

- EEA YouTube channel on enterprise engagement, human capital, and total rewards since 2020

Management Academy to enhance future equity value for your organization.

Management Academy to enhance future equity value for your organization.3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

Contact: Bruce Bolger at TheICEE.org; 914-591-7600, ext. 230.