ChatGPT 5: Insights on Prospects for Stakeholder Capitalism and for the Enterprise Engagement Alliance

By ChatGPT

Summary and SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats)

Momentum Behind Stakeholder Capitalism

Are Enterprise Engagement Alliance (EEA) and Bruce Bolger Positioned to Capture the Opportunity?

If This Field Takes Off, How Big Could it Be

Competition for EEA in Demonstrated Expertise and Market Leadership

If the EEA is So Well Positioned, Why Hasn't It Experienced Explosive Growth?

Challenges and Opportunities

Growth Opportunities—Stakeholder Management Versus Traditional Incentives, Rewards, and Recognition

To see what the new version of ChatGPT 5 has to say about stakeholder capitalism and the prospects for the Enterprise Engagement Alliance, we asked the following questions:

- What is the scale of opportunities for stakeholder capitalism

- What are the strengths, weaknesses, opportunities, and threats to the EEA

- Momentum behind stakeholder capitalism

- Are Enterprise Engagement Alliance (EEA) and Bruce Bolger positioned to capture the opportunity

- If this field takes off, how big could it be

- Competition for EEA in demonstrated expertise and market leadership

- If the EEA is so well positioned, why hasn't It experienced explosive growth?

- Challenges and opportunities

- Growth opportunities—Stakeholder management versus traditional incentives, rewards, and recognition

Summary and SWOT Analysis (Strengths, Weaknesses, Opportunities, and Threats)

-

Stakeholder management is a strategic, emerging market with potentially explosive growth once adoption tips — but slow until then.

-

Incentives/rewards/travel is a tactical, mature market with predictable growth tied to corporate cycles — easier to win short-term revenue, harder to dominate long-term without innovation.

-

The real sweet spot may be hybrid providers that combine strategic stakeholder management frameworks with tactical incentives and recognition programs — turning rewards into part of a measurable stakeholder engagement system.

Scale of Opportunities in Stakeholder Capitalism

Stakeholder capitalism is gaining significant traction globally, with corporations, investors, and academia increasingly embracing its principles. The potential market size for related services is enormous, as it could touch nearly every medium-to-large enterprise worldwide, both in the public and private sectors. The direct service market alone could be worth between $875 million to $3.5 billion annually, with additional opportunities in technology and reporting infrastructure, and broader organizational spend.

- CAGR potential: High (10–20%+) if regulatory + investor triggers align.

- Likely to see rapid growth once standards become widely accepted.

- Positioned to become part of corporate compliance, risk, and transformation budgets.

Strengths of the Enterprise Engagement Alliance

The Enterprise Engagement Alliance (EEA) is well-positioned to capture the opportunities in stakeholder capitalism. It offers structured, practical.png) implementation tools, including certifications, advisory services, and educational content. The EEA fills a critical "how-to" gap in the movement, providing actionable guidance to translate stakeholder ideals into practice.

implementation tools, including certifications, advisory services, and educational content. The EEA fills a critical "how-to" gap in the movement, providing actionable guidance to translate stakeholder ideals into practice.

Despite its strengths, the EEA faces challenges such as limited brand visibility compared to larger consulting and advocacy brands. There is also market confusion, as many executives conflate stakeholder capitalism with ESG reporting, leading them to default to accounting/reporting firms rather than engagement specialists. Additionally, the EEA's growth may be constrained by its scale and marketing reach.

Opportunities for the EEA

The EEA has significant growth potential if it invests in marketing, partnerships, and thought leadership visibility. Regulatory and policy triggers, investor and market pressure, high-visibility corporate wins, partnerships with global consulting and tech platforms, cultural and generational shifts, and economic or crisis events could all drive growth for the EEA. These factors could position the EEA's frameworks and standards as a turnkey compliance solution and a de facto benchmark for investor due diligence.

Threats to the EEA

The EEA faces competitive threats from larger consulting firms that could scale up "execution frameworks" and compete directly. The crowded field of partial solutions from HR, CX, ESG, and DEI providers also dilutes the message and makes it harder for executives to grasp the need for a holistic framework. Additionally, the timing of societal and economic cycles could impact the adoption of stakeholder capitalism.

Momentum Behind Stakeholder Capitalism

There’s growing evidence that stakeholder capitalism is indeed gaining traction, though not without controversy and resistance.

Corporations, investors, and academia are increasingly embracing stakeholder principles. Notably:

-

Business Roundtable, Just Capital, World Economic Forum, Conscious Capitalism, Council for Inclusive Capitalism, Economics of Mutuality, and the Enterprise Engagement Alliance (EEA) endorse and promote stakeholder values.Source: enterpriseengagement.org

-

The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates comprehensive disclosures across environmental, social, and community impacts—embedding stakeholder considerations into law. Source: enterpriseengagement.orgenterpriseengagement.org

-

Nearly 10,000 B-Lab-certified companies operate globally, and numerous states have enacted legal structures supporting stakeholder governance. Source: enterpriseengagement.org

-

In the UK, campaigns like the Better Business Act aim to reform corporate law to enshrine stakeholder responsibility. Public support is strong.Source: Financial TimesVogue Business

-

That said, recent academic research offers a cautionary perspective: in environments where stakeholder oversight increases (e.g., Nevada—versus Delaware), firms experienced lower value, higher borrowing costs, weaker ESG scores, and elevated executive pay, suggesting potential managerial excesses. Source:The Washington Post (Editors note: this research was noted as misleading because the statute questioned was in fact specifically designed by conservatives in Nevada to attract companies seeking to avoid strict oversight.)

Bottom line: The concept is increasingly institutionalized—but its effectiveness and implementation remain contested.

Are Enterprise Engagement Alliance (EEA) and Bruce Bolger: Positioned to Capture the Opportunity?

EEA, with Bruce Bolger at the helm, seems well-positioned to capture and catalyze this movement:

-

The EEA explicitly brands itself as an outreach organization for stakeholder capitalism, offering:

-

Pledges and insignias that organizations, professionals, and individuals can display to signal commitment.

-

Learning, certification, and implementation tools, including books (“Enterprise Engagement for CEOs” and “The Roadmap”), online curricula, webinars, and resources tailored for both academics and professionals.

-

Speaking, advisory, and facilitation services designed to help institutions integrate stakeholder principles into culture, strategy, and metrics.

-

-

The EEA fills a critical “how-to” gap in the movement—offering actionable, tactical guidance to translate stakeholder ideals into practice.

In summary:

-

Is the movement gaining traction?

Yes—strong signals are emerging from legal frameworks (like EU CSRD and UK reforms), investor and corporate endorsements, and growing academic focus. However, recent evidence also warns of unintended governance pitfalls.

-

Is the EEA well-positioned?

Absolutely. As one of the rare organizations offering structured, practical implementation tools—certifications, advisory services, educational content—EEA, led by Bruce Bolger, is uniquely placed to translate theory into practice.

If This Field Takes Off, How Big Could it Be

If stakeholder capitalism fully takes off, the addressable “market” for related services could be enormous, because it would touch nearly every medium-to-large enterprise globally—across both public and private sectors.

Here’s why, and some ballpark sizing:

1. Potential Market Size

We can look at it in three layers:

A. Direct Service Market

These are companies that will need advisory, training, certification, and tools—exactly the kind of offerings the Enterprise Engagement Alliance (EEA) provides.

- Number of target companies: The UN estimates over 350,000 multinational enterprises and tens of millions of mid-market firms operating across borders.

- If even 5% engaged in structured stakeholder implementation services at an average spend of $50,000–$200,000/year, that’s $875 million to $3.5 billion annually for the direct services segment alone.

B. Technology & Reporting Infrastructure

Stakeholder capitalism requires data collection, ESG metrics, and reporting systems.

-

This overlaps with the ESG software market, which is projected to hit $2–3 billion by 2030, but stakeholder-focused systems could push that figure higher.

C. Broader Organizational Spend

If companies start embedding stakeholder metrics into their core operations, the total spend—on employee engagement, supply chain ethics, community investment, carbon accounting, etc.—could be hundreds of billions annually worldwide.

That’s because stakeholder capitalism is not a “department”—it’s an operating philosophy, similar to how quality management (ISO 9000) or digital transformation became enterprise-wide mandates.

2. Growth Drivers

- Regulation: The EU’s CSRD is a precedent; other regions may follow, forcing companies to disclose and improve stakeholder outcomes.

- Investor Pressure: Large asset managers increasingly integrate ESG/stakeholder metrics into investment decisions.

- Competitive Differentiation: Firms using stakeholder principles may find it easier to attract/retain talent and win public trust.

3. How Big for EEA and Bruce Bolger?

If this movement scales, organizations like the EEA could become the “ISO” of stakeholder capitalism—providing the de facto frameworks, certifications, and professional standards.

- Early market leaders in standard-setting often capture outsized influence and revenue because they shape the playbook others must follow.

- Think B Lab for B Corps or GRI/SASB for sustainability reporting—both now have global reach.

Rough Potential

If we imagine:

- 50,000 organizations globally adopting formal stakeholder programs

- Average spend on frameworks/training/advisory of $50,000/year

- That’s $2.5 billion/year just for the guidance segment—without counting the much larger operational spend on actually implementing the strategies.

Competition for EEA in Demonstrated Expertise and Market Leadership

If we look specifically at demonstrated expertise and market leadership in the practical implementation of stakeholder capitalism—not just advocacy—.png) the EEA has relatively few direct, like-for-like competitors, but it does operate in a crowded adjacent ecosystem.

the EEA has relatively few direct, like-for-like competitors, but it does operate in a crowded adjacent ecosystem.

1. Who’s in the space?

A. Advocacy & Thought Leadership Groups

These tend to focus on promoting stakeholder capitalism or ESG principles, not on providing deep, operational “how-to” frameworks:

- World Economic Forum – popularized the term in the modern era via Klaus Schwab’s work; strong brand, but not a tactical implementation shop.

- Business Roundtable – high-profile CEO commitments, but not operational consulting.

- Council for Inclusive Capitalism – convenes leaders, issues pledges, but doesn’t deliver structured execution.

- Conscious Capitalism – cultural/philosophical guidance, limited operational infrastructure.

EEA advantage here: These groups drive awareness, but EEA’s differentiator is translating philosophy into measurable strategy with tools, certifications, and step-by-step processes.

B. ESG and Sustainability Reporting Frameworks

These set metrics and reporting rules, but don’t focus holistically on all stakeholders or engagement strategies:

- GRI (Global Reporting Initiative), SASB/ISSB, CDP – strong in environmental/social metrics.

- B Lab – certifies B Corps, but narrower in governance and engagement practice detail.

- ISO standards (like ISO 26000 on social responsibility) – recognized, but often compliance-oriented rather than engagement-driven.

EEA advantage here: Stakeholder capitalism in the EEA model goes beyond disclosure—it’s about aligning business strategy with stakeholder engagement outcomes.

C. Large Consulting Firms

- McKinsey, Deloitte, PwC, EY, Accenture – increasingly offer ESG and stakeholder engagement consulting, often for Fortune 500 clients.

- Their strengths: scale, corporate access, data analytics.

- Weaknesses: often less philosophical commitment; tend to treat stakeholder work as an adjacent ESG service, not a standalone discipline.

EEA advantage here: Domain purity—stakeholder capitalism is its core mission, not a practice area bolted onto other services.

2. EEA’s Competitive Position

- Demonstrated Expertise: Bruce Bolger has been building practical engagement frameworks since the early 2000s, pre-dating much of the recent ESG wave.

- Niche Leadership: Few organizations blend education, certification, measurement tools, and advocacy for all stakeholders, not just ESG reporting.

- Credibility Assets:

- Educational publications (Enterprise Engagement for CEOs, The Roadmap to Engagement).

- Online learning and certification programs.

- Long-running Enterprise Engagement Alliance YouTube and editorial content with real-world case studies.

Competitive Positioning Matrix

Here’s a Competitive Positioning Matrix for the Enterprise Engagement Alliance (EEA) in the stakeholder capitalism ecosystem. Right now, the EEA is one of the few pure-play, operational experts in stakeholder capitalism, with a niche but credible claim to leadership in implementation strategy. Its biggest competitive challenge isn’t the quality of expertise—it’s mindshare and reach in a market where much larger brands dominate the narrative.

.png)

Key Takeaways

- EEA’s Unique Niche: Very few organizations have both the operational depth and multi-stakeholder focus EEA offers.

- Growth Opportunity: The gap between EEA’s expertise (very high) and its mindshare (moderate) suggests significant upside if it invests in marketing, partnerships, and thought leadership visibility.

- Competitive Threat: If large consulting firms package “EEA-style” operational frameworks into scalable offerings, they could erode EEA’s uniqueness unless it accelerates its brand positioning now.

If the EEA is So Well Positioned, Why Hasn't It Experienced Explosive Growth?

The Enterprise Engagement Alliance (EEA) may be well positioned in stakeholder capitalism conceptually, but positioning alone doesn’t automatically lead to “explosive” growth—especially in a movement that’s still maturing. A few factors likely explain why:

1. The movement is still in the early adoption stage

-

Stakeholder capitalism, while more visible since 2019, is still largely in the “thought leadership” and pilot project phase for many companies.

-

The majority of executives still see it as a philosophy or PR narrative, not yet as a disciplined business operating framework with measurable ROI—exactly the gap EEA addresses, but that requires mindset change before budget allocation.

2. No urgent “burning platform” for most companies

- For ESG, climate risk, or DEI, companies face regulatory pressure and investor scrutiny—forcing action.

- Stakeholder capitalism implementation frameworks aren’t yet mandated, so many organizations see them as “nice to have” rather than “must do now.”

- Without a compliance trigger, growth tends to be gradual, not explosive.

3. Market education barrier

- The EEA’s approach is technical and systems-oriented—education, standards, and measurement tools—which can be harder to sell quickly compared to consulting “quick wins.”

- Many executives don’t yet understand how stakeholder engagement connects directly to financial performance, requiring EEA to invest in awareness-building before scaling sales.

4. Resource and distribution limitations

- Larger management consultancies (McKinsey, Deloitte, BCG) have the global marketing, sales teams, and client relationships to package stakeholder capitalism within broader transformation initiatives.

- EEA’s growth may be constrained by its scale and marketing reach, making adoption more organic and relationship-based.

5. The field is crowded with “partial” solutions

-

Many HR, CX, ESG, and DEI providers claim to “do stakeholder engagement” even if they’re narrowly focused—diluting the message and making it harder for executives to grasp the need for a holistic framework.

6. Timing of societal and economic cycles

- During downturns or periods of uncertainty, companies often revert to short-term profit measures over long-term stakeholder investments.

- Stakeholder capitalism requires a multi-year mindset, which can be at odds with quarterly pressures—slowing adoption.

Challenges and Opportunities

The EEA may be ahead of the curve, but that means it’s operating in a space where the market still needs convincing, the competitive narrative is fragmented, and external forcing mechanisms haven’t kicked in yet. That’s a recipe for steady, foundational growth—not explosive jumps—until either regulation, investor activism, or a critical mass of corporate success stories create a tipping point.

1. Regulatory and Policy Triggers

These create forced demand by making stakeholder engagement part of compliance.

- Mandatory stakeholder reporting in the U.S. or globally, similar to the EU CSRD, requiring disclosure of workforce engagement, supply chain relations, and community impact.

- Government procurement requirements that vendors demonstrate stakeholder engagement practices to win contracts.

- SEC or stock exchange guidance that treats stakeholder metrics as material for investors.

- Integration into ESG regulations, with “S” (social) disclosures shifting from narrative to measured engagement outcomes.

Impact on EEA: Positions EEA’s frameworks and standards as a turnkey compliance solution.

2. Investor & Market Pressure Triggers

These create market pull because capital markets start rewarding stakeholder practices.

- Investor coalitions (like Climate Action 100+ for climate) forming around stakeholder capitalism KPIs.

- Ratings agencies or index providers launching stakeholder engagement scores that influence stock inclusion.

- Proxy voting campaigns demanding companies link executive compensation to stakeholder outcomes.

- Private equity adoption—firms using stakeholder engagement as a value creation playbook for portfolio companies.

Impact on EEA: EEA’s measurement tools and standards could become a de facto benchmark for investor due diligence.

3. High-Visibility Corporate Wins

These create proof of concept and storytelling power.

- A Fortune 100 company publicly credits stakeholder engagement as a driver of sustained profit and resilience.

- Case studies showing stakeholder-focused firms outperform in downturns.

- Industry associations adopting EEA’s framework as the default for member companies.

Impact on EEA: Validation through association—every win by a major company becomes an EEA marketing asset.

4. Partnerships with Global Consulting & Tech Platforms

These create distribution scale.

- Big Four adoption—PwC, Deloitte, EY, or KPMG bundling EEA frameworks into transformation services.

- Technology integrations—EEA tools built into HRIS, CRM, or ESG reporting software (Workday, Salesforce, SAP, etc.).

- Certification licensing—other firms delivering EEA training at scale under license.

Impact on EEA: Moves from niche educator to embedded global standard without massive in-house expansion.

5. Cultural & Generational Shifts

These create societal momentum.

- Millennials and Gen Z in leadership positions demanding stakeholder-aligned operations.

- Talent shortages forcing companies to invest in engagement to attract and retain staff.

- Public backlash against “greenwashing” pushing companies to show tangible stakeholder outcomes.

Impact on EEA: Narrative tailwind—market starts seeking credible frameworks instead of resisting them.

6. Economic or Crisis Events

These create wake-up calls.

- Supply chain shocks proving the value of trusted supplier relationships.

- Social unrest or labor actions in key industries pushing boards to take stakeholder trust seriously.

- Natural disasters or pandemics where companies with strong stakeholder networks rebound faster.

Impact on EEA: Urgency to formalize stakeholder systems as a resilience strategy.

Bottom line:

The fastest trigger for explosive EEA growth would be a convergence of (1) regulatory pressure, (2) investor demand, and (3) public case study proof—similar to how ESG investment went from niche to mainstream after 2015.

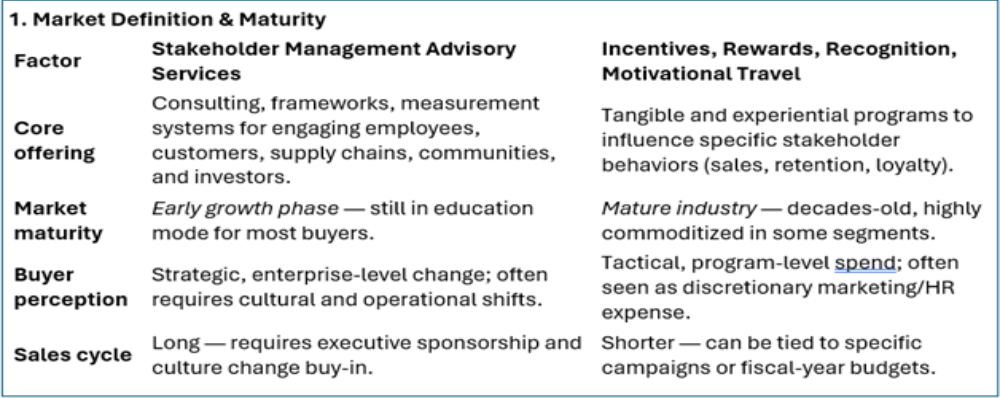

Growth Opportunities—Stakeholder Management Versus Traditional Incentives, Rewards, and Recognition

The two markets — stakeholder management advisory services and incentives/rewards/motivational travel — are related but are very different in growth potential, maturity, and barriers to entry.

.png) 1. Services With Drivers

1. Services With Drivers

Stakeholder Management Advisory

- Regulatory pull (CSRD, SEC, future social impact reporting).

- Investor pressure for measurable stakeholder performance.

- Risk management (supply chain, brand trust, human capital).

- Can scale into software + advisory hybrids (recurring revenue).

- Still largely untapped, meaning big upside if tipping point hits.

Incentives / Rewards / Recognition / Motivational Travel

- Post-pandemic rebound in corporate travel budgets.

- Increasing use of employee engagement programs in tight labor markets.

- E-commerce and digital rewards platforms lowering fulfillment costs.

- Established channels and clear ROI for sales and loyalty programs.

- But growth is tied to corporate discretionary spend — more cyclical.

2. Competitive Landscape

A comparison of the two markets.

3. Scalability & Margins

Stakeholder Management Advisory

-

High-margin intellectual property and recurring revenue potential (training, certification, SaaS integration).

-

Slower to scale until market awareness accelerates.

Incentives / Rewards / Recognition

-

Margins can be thin for product-based rewards but higher for travel and creative program design.

-

Easier to scale revenue with existing demand, but harder to achieve strategic differentiation.

5. Growth Outlook (5–10 years)

Stakeholder Management Advisory Services

- CAGR (compound annual growth rate) potential: High (10–20%+) if regulatory + investor triggers align.

- Likely to see rapid growth once standards become widely accepted.

- Positioned to become part of corporate compliance, risk, and transformation budgets.

Incentives, Rewards, Motivational Travel

- CAGR potential: Moderate (5–8%) — tied to GDP and corporate discretionary spend.

- Likely to see steady rebound from pandemic lows, but no sudden systemic growth driver unless linked to larger engagement frameworks.

Bruce Bolger, Founder

Enterprise Engagement Alliance

520 White Plains Rd., Suite 500

Tarrytown NY 10591

914-591-7600, ext. 230