AlphaCalc® Performance Dashboard Transforms Human Capital Management

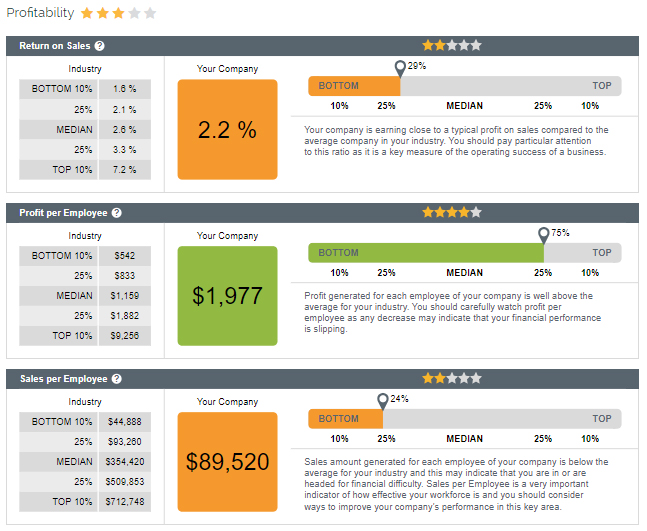

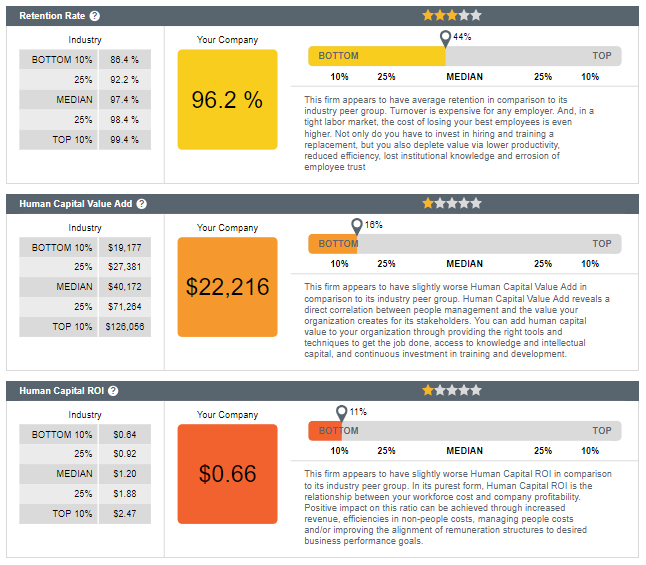

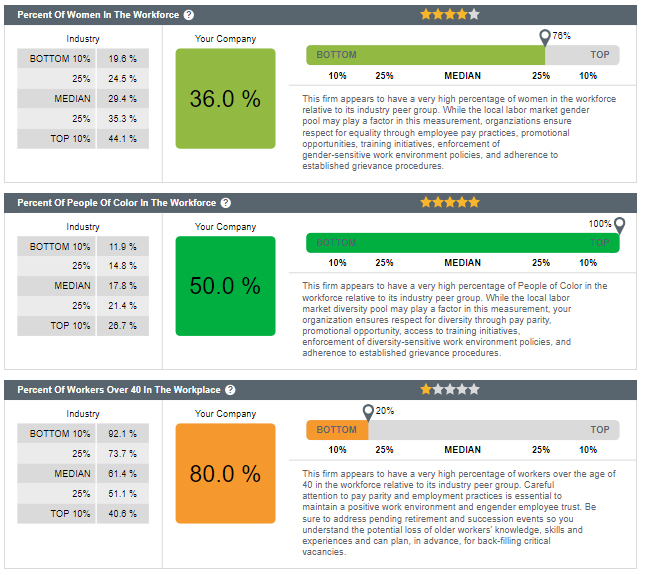

29Bison, a human capital management consultant for private equity and venture capital firms and their portfolio companies, has launched AlphaCalc®, a business intelligence SaaS (software as a service) platform designed to enhance due diligence, portfolio-monitoring, and value-creation processes, as well as provide management of almost any size company powerful ways to track and benchmark key human capital factors, including:

29Bison, a human capital management consultant for private equity and venture capital firms and their portfolio companies, has launched AlphaCalc®, a business intelligence SaaS (software as a service) platform designed to enhance due diligence, portfolio-monitoring, and value-creation processes, as well as provide management of almost any size company powerful ways to track and benchmark key human capital factors, including: AlphaCalc’s reports provide some of the key human capital metrics covered in a recent EEA Zoom Show: Human Capital Management, Metrics, and ROI of Engagement

AlphaCalc’s reports provide some of the key human capital metrics covered in a recent EEA Zoom Show: Human Capital Management, Metrics, and ROI of EngagementThe First Human Capital Metrics Benchmark Platform

“We believe this tool is invaluable to CFOs and CEOs to better manage their businesses, whether they wish to sell their companies next year or in 20 years. By putting both critical financial measures and human capital metrics on the same platform, they can ensure a clear connection between their investments in people and the impact on performance,” says Laura Queen, Founder and CEO of 29Bison.

“We believe this tool is invaluable to CFOs and CEOs to better manage their businesses, whether they wish to sell their companies next year or in 20 years. By putting both critical financial measures and human capital metrics on the same platform, they can ensure a clear connection between their investments in people and the impact on performance,” says Laura Queen, Founder and CEO of 29Bison.Designed for M&A Specialists and Any Business Leader

Originally created to help investors and managers in the mid-cap mergers and acquisition business, AlphaCalc has clear benefits for any business owner or CEO to create a rapid and powerful financial and human capital performance scorecard. According to Eric Lane, Partner and COO of 29Bison.com, “Our focus, of course, is on helping private equity firms and the strategic investors we serve. It’s clear AlphaCalc provides value to a far broader market and can help any CEO and management or outside advisory team set up a scorecard to help determine how well a company is doing in terms of human capital and financial management, against its own benchmarks and those of others in its industry or geographic region.”

Originally created to help investors and managers in the mid-cap mergers and acquisition business, AlphaCalc has clear benefits for any business owner or CEO to create a rapid and powerful financial and human capital performance scorecard. According to Eric Lane, Partner and COO of 29Bison.com, “Our focus, of course, is on helping private equity firms and the strategic investors we serve. It’s clear AlphaCalc provides value to a far broader market and can help any CEO and management or outside advisory team set up a scorecard to help determine how well a company is doing in terms of human capital and financial management, against its own benchmarks and those of others in its industry or geographic region.”A Performance Management Dashboard

According to the company, “AlphaCalc’s powerful AI-driven analysis engine distills insights in business performance across key financial and human capital metrics. An automated dashboard delivers actionable analytics, bespoke to the target industry, highlighting areas of concern and opportunities for improvement. With integrated deep data mining from over 2,600 industries and nearly one million private businesses, the AlphaCalc platform provides key benchmarks relevant to private middle-market businesses and, through incorporating human capital metrics, helps make intangible assets tangible and appreciable to business performance.”

According to the company, “AlphaCalc’s powerful AI-driven analysis engine distills insights in business performance across key financial and human capital metrics. An automated dashboard delivers actionable analytics, bespoke to the target industry, highlighting areas of concern and opportunities for improvement. With integrated deep data mining from over 2,600 industries and nearly one million private businesses, the AlphaCalc platform provides key benchmarks relevant to private middle-market businesses and, through incorporating human capital metrics, helps make intangible assets tangible and appreciable to business performance.” Master the Principles of Stakeholder Capitalism And Implementation Through Enterprise Engagement

This is the definitive implementation guide to Stakeholder Capitalism, written specifically to provide CEOs and their leadership teams a concise overview of the framework, economics, and implementation process of a CEO-led strategic and systematic approach to achieving success through people. (123 pages, $15.99)

The first and most comprehensive book on Enterprise Engagement and the new ISO 9001 and ISO 10018 quality people management standards. Includes 36 chapters detailing how to better integrate and align engagement efforts across the enterprise. (312 pages, $36.)

OTHER RESOURCES TO ACTUALIZE STAKEHOLDER CAPITALISM

Communities: The Enterprise Engagement Alliance and Advocate and the Brand Media Coalition free resource centers offering access to the latest research, news, and case studies; discounts, promotions, referrals, and commissions, when appropriate to third-party solution providers from participating coalition solution provider members.

Online Overview:

10-minute short course: click here for a 10-minute introduction to Enterprise Engagement and ISO standards from the Coggno.com learning platform.

Services:

• The Engagement Agency at EngagementAgency.net, offering: complete support services for employers, solution providers, and technology firms seeking to profit from formal engagement practices for themselves or their clients, including Brand and Capability audits for solution providers to make sure their products and services are up to date.

• C-Suite Advisory Service—Education of boards, investors, and C-suite executives on the economics, framework, and implementation processes of Enterprise Engagement.

• Speakers Bureau—Select the right speaker on any aspect of engagement for your next event.

• Mergers and Acquisitions. The Engagement Agency’s Mergers and Acquisition group is aware of multiple companies seeking to purchase firms in the engagement field. Contact Michael Mazer in confidence if your company is potentially for sale at 303-320-3777.

Enterprise Engagement Benchmark Tools: The Enterprise Engagement Alliance offers three tools to help organizations profit from Engagement. Click here to access the tools.

• ROI of Engagement Calculator. Use this tool to determine the potential return-on-investment of an engagement strategy.

• EE Benchmark Indicator. Confidentially benchmark your organization’s Enterprise Engagement practices against organizations and best practices.

• Compare Your Company’s Level of Engagement. Quickly compare your organization’s level of engagement to those of others based on the same criteria as the EEA’s Engaged Company Stock Index.

• Gauge Your Personal Level of Engagement. This survey, donated by Horsepower, enables individuals to gauge their own personal levels of engagement.

For more information, contact Bruce Bolger at Bolger@TheEEA.org, 914-591-7600, ext. 230.