CFO Corner: Itís Time to Find Out Where the Money Is Going

Financial reporting, audits, management discussion and analysis are no longer “fit for purpose.” They don’t tell enough about how management is spending the investors’ resources, nor about whether their business model remains sustainable—meaning, from a CFO’s point of view—a “going concern.”

Financial reporting, audits, management discussion and analysis are no longer “fit for purpose.” They don’t tell enough about how management is spending the investors’ resources, nor about whether their business model remains sustainable—meaning, from a CFO’s point of view—a “going concern.”By Nick Shepherd

The Need to Focus on People

Practical Accounting Steps Available Now

Significant Value Is at Stake

The human resources media is increasingly abuzz about human capital analytics and ISO human capital and related standards, but the accounting profession can play an important role as well in helping investors and other stakeholders understand the true health of an organization.

Investors and others have realized that companies are not accounting for what is in most cases is their largest expenses—their people—and have been pushing for greater transparency and accountability. While investments in capital and equipment are broken out on financial statements and accounted for over time, almost all investments in people are treated as a direct expense buried in financial statements and in general goodwill on the balance sheet.

The discussions around integrated thinking and the concept of six forms of capitals (financial, manufactured, natural, human, intellectual and social and relationships) was a high point in moving towards a more comprehensive approach to understanding the integrity and sustainability of the business model. But the accounting profession continues to lag.

Editors note: Shepherd’s column was submitted to ESM just before online publication of an article in the January-February print issue of Harvard Business Review by Wharton professor Peter Cappelli making a similar point: How Financial Accounting Screws Up HR.

The Need to Focus on People

The integrated agenda has been highjacked by the focus on climate issues which heavily biases ESG (Environmental, Social, Governance.) There remains no solid bridge or understanding between the deployment of financial capital and the investments necessary in people—customers, employees, distribution and supply chain partners, and communities--to sustain a business model, where the risk of failure comes from the health of invisible but critical assets that accounting fails to recognize, track or report upon—in any manner.

Examples abound. For instance, there is currently no way to account for the direct and indirect benefits of people such as Bill Gates and his partners in their creation of Microsoft. Unlike direct research and development costs, which are disclosed so they can be evaluated over time, there exists no way in financial reporting to know how much Microsoft invested to onboard talent, train and develop its people, or in communications, rewards, and recognition, not to mention the costs to develop its customer base and distribution channel that clearly has created enormous value for many. Nor is there any way to evaluate what those investments yielded in terms of a long-term contribution to its shareholders’ assets, nor the indirect benefits to its communities--not only by creating jobs but also opportunities for independent companies to use Microsoft technologies to create their own in many cases profitable businesses.

On the other hand, what means do Twitter’s lenders or other investors have at hand to evaluate the long-term impact of Elon Musk’s historic job cuts and other controversial actions on the company’s value--other than waiting to see what happens perhaps several years or more down the line. Does anyone remember “Chainsaw Al”? His history does not bode well for Elon Musk.

Practical Accounting Steps Available Now

Trying to change accounting standards is a long process. So how can progressive investors, boards and CEOs and CFOs start now under current accounting rules to tell a better story about where the money is going? Here are some foundational steps to consider.

-

Provide a breakout of operating expenses on the income statement between people costs (customers, employees, and distribution partners, etc.) incurred for current revenue generation, such as salaries commissions and related direct operating costs, and those incurred as investment spending related to “future-oriented intangibles.” Examples include: recruiting, training and development, hiring and orientation, leadership development, relationship building on supply chains and with other partners, job design, loyalty, rewards, and recognition, etc. On the marketing side, these could include costs related to new product launches.

-

Keep a cumulative total of these “future-oriented intangible investments” to demonstrate the importance and historic investment in these critical components of the business model.

-

At the end of every fiscal reporting period, review these cumulative totals for impairment (a permanent reduction in the value of a company asset), in the same way goodwill is assessed for continued “value” creation to an organization. After all, goodwill contains these same elements of intangible value creation or destruction when crystallized in a merger/acquisition valuation process.

-

Expand “notes to the accounts” to provide commentary on existing independent valuations of core intangible assets such as brand value created—insights that can be provided by such companies as Brand Finance, Interbrand, or Kantar. As illustrated above, for many companies, especially in technology, value reflects one of the largest value outcomes of intangible investments.

-

Require MD&A (Management Discussion and Analysis) to address the quality and health of the business model specifically related to the “non-financial” investment out of cash flow needed to create and sustain the desired outcomes from the investment in people.

- For good measure, if management really wants to enhance its reputation as a responsible business, add disclosure and commentary of fines and penalties levied, such as those tracked by Violation Tracker in the USA or the UK that indicate direct impacts on depletion of investor value.

Significant Value Is at Stake

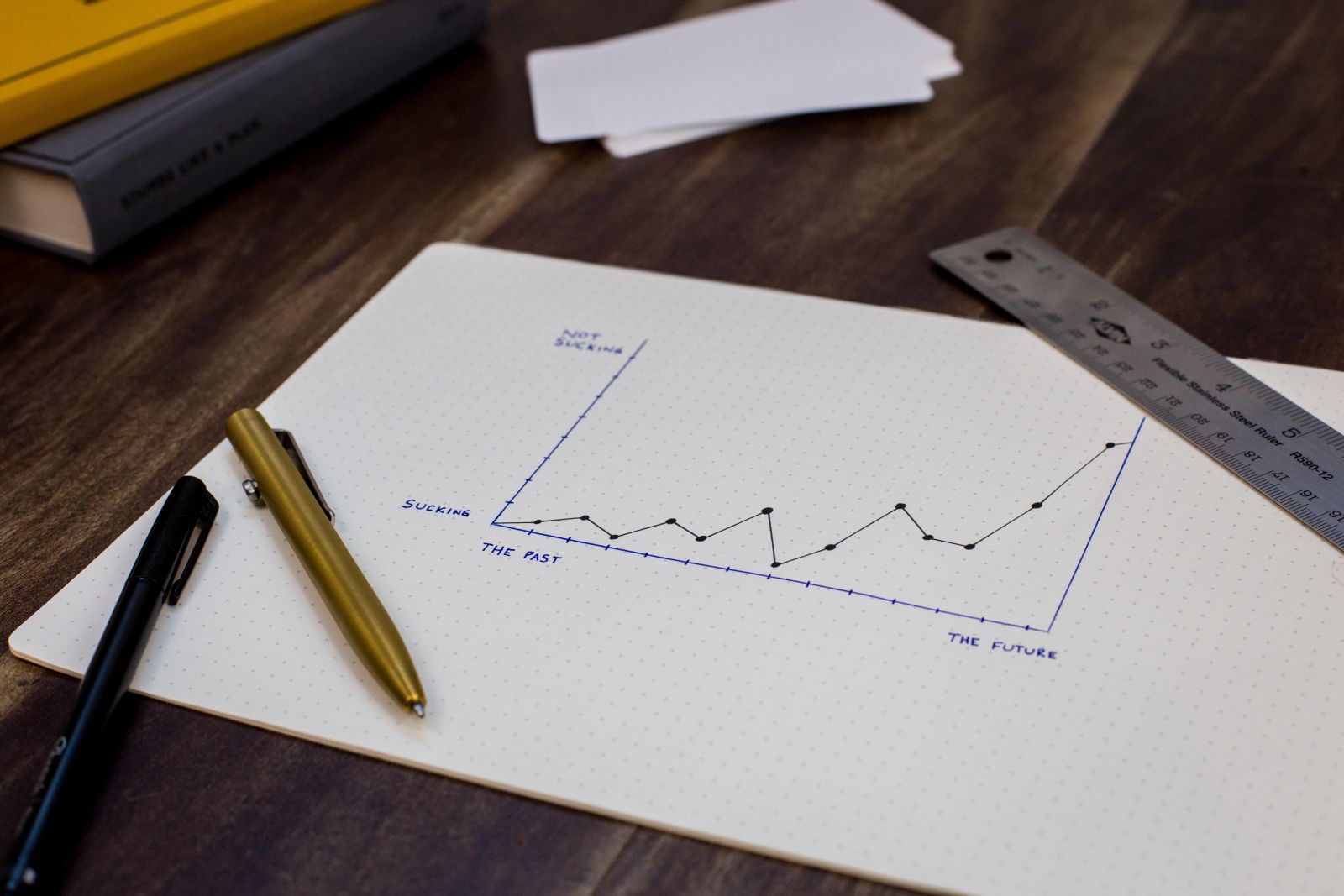

The cost of this weakness in accounting standards is not a rounding error. With the ever-increasing gap that has grown between the actual market value of a business entity and the accounting valuations created by the current approaches to tracking and reporting on the source and application of investor funds, investors need better insights into both where their money has gone and the health of the investments that management has chosen to create and sustain their business models.

Audits and financial reporting are seen as an early warning sign of organizational problems; yet, the negative impact caused by the depletion of key resources such as critical supplier relationships or poor people leadership including employee and customer turnover are often not revealed as an issue until they show up in declining financials. By then it’s too late. If boards and management wish to enhance the story they are telling, they need to change the narrative to one that more closely reflects the reality of today’s business model.

The issue of stakeholder management reporting is as much a financial responsibility of the CFO as it is a human resources or marketing consideration, as meaningful financial reporting of people investments is really the only way to provide early warning signals triggered by human events that are anything but intangible when it comes to their potential impact on financial risk or opportunity.

Nick Shepherd

Eduvision Inc.

Eduvision.com

Nick@eduvision.com

Subscribe to ESM's weekly newsletter.

Profit From the “S” of Environmental, Social, Governance (ESG)

Profit From the “S” of Environmental, Social, Governance (ESG)Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

-

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources. - The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services.