Stakeholder Capitalism in the News: WSJ Promotes the Cause; ESG Is Little Understood; Purpose Statements Are Critical

Here is a recap of recent articles and research about Stakeholder Capitalism and ESG (Environmental, Social, Governance (ESG).

Here is a recap of recent articles and research about Stakeholder Capitalism and ESG (Environmental, Social, Governance (ESG).Wall Street Journal Salutes Top 250 Leaders in Stakeholder Capitalism

JUST Capital Focus Groups on ESG Find Lack of Awareness, Confusion

Conference Board Op-ed in Barrons: ESG Is Changing Board Composition

Attorneys Suggest How Companies Can Steer Clear of Politics

The Wall Street Journal highlights the 250 leaders in Stakeholder Capitalism....JUST Capital survey finds low awareness and high confusion surrounding ESG...Barron’s publishes a Conference Board op-ed piece on how ESG is changing the composition of corporate boards...Harvard Law School Forum article says a strong purpose statement helps companies navigate politics.

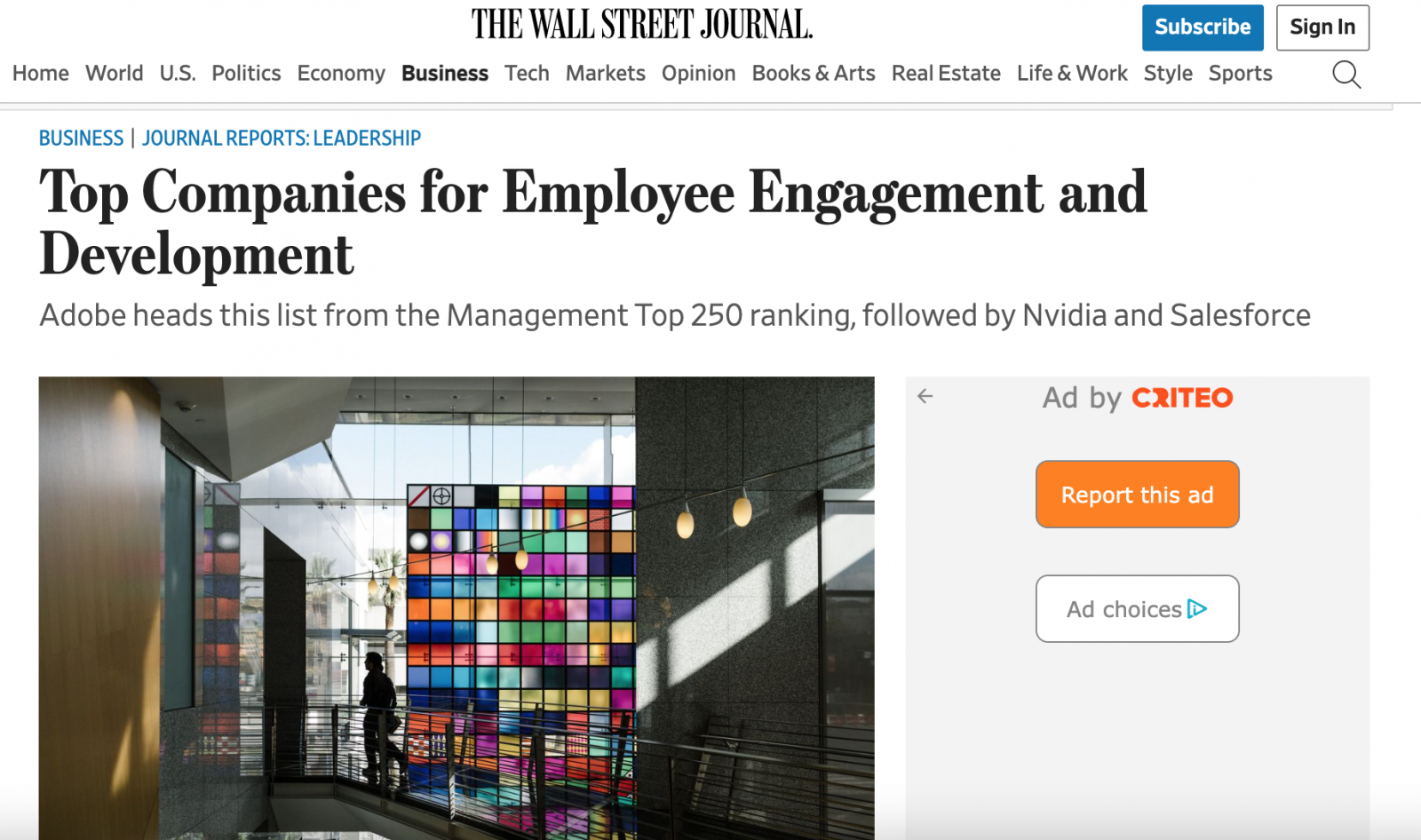

Wall Street Journal Salutes Top 250 Leaders in Stakeholder Capitalism

While some conservatives mount an attack on ESG, the conservative News Corp. media is generally supportive. The Wall Street Journal has teamed up again with the Drucker Institute to highlight the leading companies in Stakeholder Capitalism, ranked by customer satisfaction; employee engagement and development; innovation; social responsibility, and financial strength to derive an overall effectiveness score.According to the Wall Street Journal report, in overall effectiveness, Microsoft, Apple, IBM, General Motors, and Whirlpool score in the top 5 in that order. Adobe has the highest score for employee engagement, followed by Nvidia and Salesforce, although the survey was conducted before the recent layoffs. Adobe made the top 10 list for social responsibility. Microsoft is in the top 10 for each of the overall rankings in five main categories except customer satisfaction, including the highest score for innovation. Nvidia is in the top 10 for financial strength.

Barrons, a sister News Corp. publication, publishes an annual 100 Most Sustainable Companies report, also highlighting the best companies in Stakeholder Capitalism—i.e., those whose principles are based on enhancing returns for investors by creating more value for customers, employees, supply chain and distribution partners, communities, and the environment.

JUST Capital Focus Groups on ESG Finds Lack of Awareness, Confusion

In its weekly newsletter authored by Co-Founder Martin Whittaker, JUST Capital reports on the results of several focus groups on ESG. He writes, “what we learned is that, in fact, Americans across the board don’t really care about, or know about, this battle of ‘woke capitalism’ or ESG. Only a few participants said they had heard of the term ESG and when asked whether they thought considering non-financial metrics made sense from an investment perspective, most agreed. We confirmed (yet again) that there is widespread support across political lines for companies to look after all their stakeholders, and it’s clear a majority of Americans don’t support state funds banning ESG or other similar restrictions. They think it should be up to investors to decide what's best. This ties in with a recent survey by Penn State’s Center for the Business of Sustainability and communications firm ROKK Solutions, which found that 63% of voters – including 70% of Republicans – oppose government restrictions on ESG investments.”

Conference Board Op-ed in Barrons: ESG Is Changing Board Composition

In a recent op-ed piece in Barrons, Paul Washington, Executive Director of the Conference Board ESG Center, reports that a working group of executives from 200 leading companies finds that “a clear majority of firms—68%—say ESG will have a significant and durable impact on the board in the next five year...More than half say the same of Stakeholder Capitalism. The report recommends that investors should expect companies to clearly articulate the ESG issues that are not just material to a company, but that are strategically important. Boards should also have a decision-making framework that takes stakeholder impact into account.” The report recommends that companies make sure that they have board members with appropriate expertise in ESG; that they have a strategy for engaging with shareholders on key ESG issues of concern to them; and that they have appropriate metrics.

Attorneys Suggest How Companies Can Steer Clear of Politics

Establishing a clear purpose statement helps organizations navigate the tricky waters of politics, according to this recent article in the Harvard Law School Forum on Corporate Governance, “Public Companies and Politics: How to Co-exist.”

“For companies that want to keep away from both the political debate and the allegiance question, the path is challenging but should start with fiduciary duty basics: develop policies under a clearly articulated rationale that enhances shareholder value,” write David Lopez, Partner and Jonathan Povilonis, Associate at Cleary Gottlieb Steen & Hamilton LLP. They add, “Doing so removes the central argument cited by some observers against, for example, ESG-oriented policies: that they support a cause rather than a business objective and thereby undermine the classic corporate purpose.”

The authors provide an interesting take on how Stakeholder Capitalism” became a political football. “In the classic Milton Friedman view, business activities should be undertaken only if they contribute to the profits of a business within the bounds of law and ethical custom. Some well-known advocates for ESG have claimed to take the same approach, arguing that addressing material ESG issues is good business practice and essential to a company’s long-term financial performance. In the latter half of the last decade, as ‘Stakeholder Capitalism’ gained traction within corporate governance circles and corporate purpose was discussed in broader terms, some constituencies on the left began to put pressure on companies to be the vehicles for political or social action that dysfunctional governments seemed unable to take. Over time, the underdeveloped definitions and norms embedded in those concepts, while initially embraced by activists on the left, created room for many alternative voices, including politicians on both sides of the aisle.”

Subscribe to ESM's weekly newsletter.

Click here to learn about the EEA’s bi-partisan Change.org petition to keep politicians out of business management.

Profit From the “S” of Environmental, Social, Governance (ESG)

Profit From the “S” of Environmental, Social, Governance (ESG)

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

Profit From the “S” of Environmental, Social, Governance (ESG)

Profit From the “S” of Environmental, Social, Governance (ESG)Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

-

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources. - The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services.