Banks Created ESG and Stakeholder Capitalism, Not Social Activists

The fundamental lack of awareness of ESG (Environmental, Social, Governance) and Stakeholder Capitalism, and the attempt to politicize the concepts, have led to considerable confusion. A quick read of the original United Nations report that helped coin the term ESG clearly demonstrates the direct connection between ESG and Stakeholder Capitalism.

The fundamental lack of awareness of ESG (Environmental, Social, Governance) and Stakeholder Capitalism, and the attempt to politicize the concepts, have led to considerable confusion. A quick read of the original United Nations report that helped coin the term ESG clearly demonstrates the direct connection between ESG and Stakeholder Capitalism.By Bruce Bolger

Key Report Findings: ESG is Just Better Business

Contributors to the Report: Leading Banks and Investors

To the probable chagrin of many ESG opponents, the concept of Environmental, Social, Governance was crystallized not by United Nations but by the world’s leading banks and investment firms.

In 2004, well before the Great Recession of 2008 or the social unrest of the early 2020s, the United Nations published the document that most believe coined the term ESG--“The Global Compact: Connecting Financial Markets to a Changing World.” Nearly 20 leading banks and the Swiss government supported this report to provide “recommendations by the financial industry to better integrate environmental, social and governance issues in analysis, asset management and securities brokerage.”

These financial institutions were invited by the United Nations Secretary-General at the time Kofi Annan “to develop guidelines and recommendations on how to better integrate environmental, social, and corporate governance issues in asset management, securities brokerage services and associated research functions. Eighteen financial institutions from nine countries with total assets under management of over $6 trillion participated in developing this report and was “supported by the chief executive officers of the endorsing institutions.” The UN’s only role was to oversee “the collaborative effort that led to this report and the Swiss government provided the necessary funding.”

Key Report Findings: ESG is Just Better Business

It’s a struggle to find much differentiation between ESG and Stakeholder Capitalism in this 2004 report. Note that there is no talk of corporate social responsibility or even the need to address societal concerns outside the purview of an organization’s interests, nor is corporate social responsibility core to the principles of the diverse people and organizations that have been involved with the development of Stakeholder Capitalism over the years. Click here for a brief history of the field.

As stated in the report’s introduction, “The institutions endorsing this report are convinced that in a more globalized, interconnected, and competitive world the way that environmental, social and corporate governance issues are managed is part of companies’ overall management quality needed to compete successfully. Companies that perform better with regard to these issues can increase shareholder value by, for example, properly managing risks, anticipating regulatory action or accessing new markets, while at the same time contributing to the sustainable development of the societies in which they operate.”

The authors believe that “these issues can have a strong impact on reputation and brands, an increasingly important part of company value. The report aims at increasing the awareness of all involved financial market actors, at triggering a broader discussion, and supporting creativity and thoughtfulness in approach, rather than being prescriptive.”

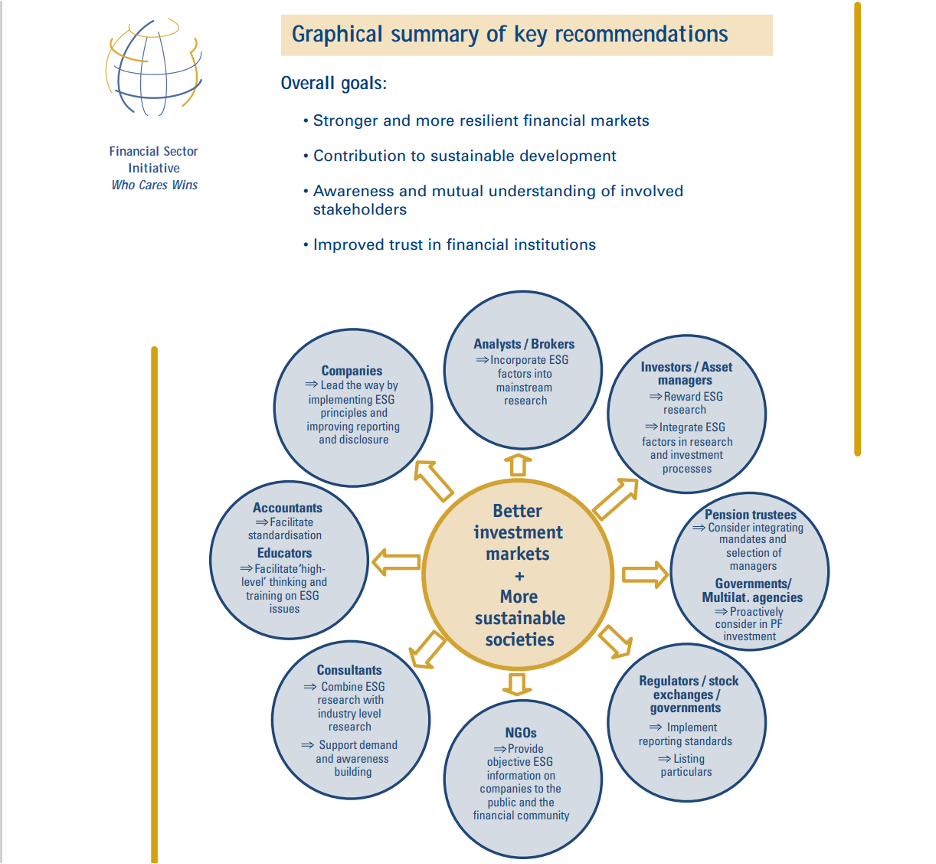

The 2004 report provides following recommendations that are almost prophetic given the new European Union Corporate Sustainability Reporting Directive taking effect this year.

- Companies should “take a leadership role by implementing environmental, social, and corporate governance principles and polices and to provide information and reports on related performance in a more consistent and standardized format. They should identify and communicate key challenges and value drivers and prioritize environmental, social and governance issues accordingly. We believe that this information is best conveyed to financial markets through normal investor relation communication channels and encourage, when relevant, an explicit mention in the annual report of companies.”

- Investors “are urged to explicitly request and reward research that includes environmental, social and governance aspects and to reward well-managed companies. Asset managers are asked to integrate research on such aspects in investment decisions and to encourage brokers and companies to provide better research and information. Both investors and asset managers should develop and communicate proxy voting strategies on ESG issues as this will support analysts and fund managers in producing relevant research and services.”

- Pension fund trustees “and their selection consultants are encouraged to consider environmental, social and governance issues in the formulation of investment mandates and the selection of investment managers, taking into account their fiduciary obligations to participants and beneficiaries. Governments and multilateral agencies are asked to proactively consider the investment of their pension funds according to the principles of sustainable development, taking into account their fiduciary obligations to participants and beneficiaries.”

- Consultants and financial advisers “should help create a greater and more stable demand for research in this area by combining research on environmental, social and governance aspects with industry level research and sharing their experience with financial market actors and companies in order to improve their reporting on these issues.”

The banks invite regulators “to shape legal frameworks in a predictable and transparent way as this will support integration in financial analysis. Regulatory frameworks should require a minimum degree of disclosure and accountability on environmental, social and governance issues from companies, as this will support financial analysis.”

Contributors to the Report: Leading Banks and Investors

- Amro

- Aviva

- AXA Group

- Banco do Brasil

- Bank Sarasin

- BNP Paribas

- Calvert Group

- CNP Assurances

- Credit Suisse Group

- Deutsche Bank

- Goldman Sachs

- Henderson Global Investors

- HSBC

- Innovest

- ISIS Asset Management

- KLP Insurance

- Morgan Stanley

- RCM (a member of Allianz Dresdner

- Asset Management)

- UBS

- Westpac

Click here to learn about the EEA’s bi-partisan Change.org petition to keep politicians out of business management.

Profit From the “S” of Environmental, Social, Governance (ESG)

Profit From the “S” of Environmental, Social, Governance (ESG)

Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

Profit From the “S” of Environmental, Social, Governance (ESG)

Profit From the “S” of Environmental, Social, Governance (ESG)Through education, media, business development, advisory services, and outreach, the Enterprise Engagement Alliance supports boards, business analysts, the C-suite, management in finance, marketing, sales, human resources and operations, etc., educators, students and engagement solution providers seeking a competitive advantage by implementing a strategic and systematic approach to stakeholder engagement across the enterprise. Click here for details on all EEA and RRN media services.

1. Professional Education on Stakeholder Management and Total Rewards

-

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources.

Become part of the EEA as an individual, corporation, or solution provider to gain access to valuable learning, thought leadership, and marketing resources. - The only education and certification program focusing on Stakeholder Engagement and Human Capital metrics and reporting, featuring seven members-only training videos that provide preparation for certification in Enterprise Engagement.

- EEA books: Paid EEA participants receive Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists, a quick implementation guide for CEOs; Enterprise Engagement: The Roadmap 5th Edition implementation guide; a comprehensive textbook for practitioners, academics, and students, plus four books on theory and implementation from leaders in Stakeholder Management, Finance, Human Capital Management, and Culture.

- ESM at EnterpriseEngagement.org, EEXAdvisors.com marketplace, ESM e–newsletters, and library.

- RRN at RewardsRecognitionNetwork.com; BrandMediaCoalition.com marketplace, RRN e-newsletters, and library.

- EEA YouTube Channel with over three dozen how-to and insight videos and growing with nearly 100 expert guests.

Strategic Business Development for Stakeholder Management and Total Rewards solution providers, including Integrated blog, social media, and e-newsletter campaigns managed by content marketing experts.

4. Advisory Services for Organizations

Stakeholder Management Business Plans; Human Capital Management, Metrics, and Reporting for organizations, including ISO human capital certifications, and services for solution providers.

5. Outreach in the US and Around the World on Stakeholder Management and Total Rewards

The EEA promotes a strategic approach to people management and total rewards through its e-newsletters, web sites, and social media reaching 20,000 professionals a month and through other activities, such as:

- Association of National Advertisers Brand Engagement 360 Knowledge Center to educate brands and agencies.

- The EEA Engagement widget to promote, track, and measure customers/employee referrals and suggestions that can be connected to any rewards or front-end program management technology.

- The Stakeholder Capitalism free insignia to promote a commitment to better business.

- The BMC Brand Club and transactional storefronts to educate corporate and agency buyers on the IRR market.

- The EME Gold program to educate the top 3% of promotional consultants on selling engagement and rewards services.