The Human Capital Factor: Managing for Engagement

Irrational Capital, creators of the Human Capital Factor, believe they have produced the first employee engagement survey process serving as a management instrument to help drive future equity value creation...i.e. better returns for the organization and investors.

Irrational Capital, creators of the Human Capital Factor, believe they have produced the first employee engagement survey process serving as a management instrument to help drive future equity value creation...i.e. better returns for the organization and investors. Independently Validated Methodology

Step 1: Treat HCF as a People Performance Dashboard

Step 2: Use the Analysis Like an X-Ray

Step 3: Pick a Few Clear Priorities (and Stick to Them)

Step 4: Translate Each Dimension into Concrete Management Actions

Step 5: Use HCF to Tune Core HR Practices

Step 6: Connect HCF to Turnover, Productivity, and Customer Outcomes

Step 7: Make HCF Part of Your Operating Rhythm

Click here to subscribe to the ESM weekly e-newsletter.

Many organizations run length-of-service or other recognition and culture enhance efforts with little connection to front-line business conditions, let alone organizaional purpose, goals, objectives, values and metrics. Most engagement surveys spit out a bunch of numbers and word clouds, and everyone nods politely, but rarely does anything happen, say the creators of the Human Capital Factor.

The Human Capital Factor (HCF) enables human resources or other leadership to focus on people management strategies where they are most likely to achieve beneficial results. How?

- The results are tied to future equity performance – not just “happy employees.”

- The findings are benchmarked against thousands of companies and analyzed by department, gender, tenure, region, seniority, and seven core cultural dimensions.

- Management gets a clear heat map identifying specifically where it should address resources to improve outcomes.

Independently Validated Methodology.png)

The Human Capital Factor® (HCF) uses an independently validated algorithm from Irrational Capital statistically and independently verified for six years in a row by J.P. Morgan analytics to link a company’s employee experience to its future equity performance.

Employee-sentiment data from engagement and culture surveys is mapped across seven dimensions—Engagement, Emotional Connection, Innovation, Direct Management, Organizational Effectiveness, Organizational Alignment, and Extrinsic Rewards. Each dimension receives a 0–10 score and is benchmarked against a database of 3,300-plus public companies and over 1.3 million survey responses.

These are the dimensions to which organizations need to manage to optimize performance, it believes it has proven.

The combined score is translated into a 10-tier rating system from D to A+, with “investment grade” representing the top one-third of organizations whose human-capital profiles historically correlate with stronger risk-adjusted returns. This system allows leaders and investors to evaluate culture with the same rigor as financial metrics and pinpoint where improvements can yield the greatest performance impact.”

The Human Capital Factor was featured in the ESM feature article: The Holy Grail of Investing and HR: New Solution Connects Human Capital to Return on Equity. and the more recent EEA Stakeholder Management Forum show: The Human Capital Factor: Turning People Metrics Into Durable Alpha for Investors and Companies.

Here’s how the Human Capital Factor works, according to the company.

Step 1: Treat HCF as a People Performance Dashboard

Conduct the company’s deep-dive survey to identify the overall HCF score and percentile.

- Benchmark by industry sector (what does “investment grade” look like in your industry?)

-

Evaluate seven dimensions:

- Emotional connection

- Extrinsic rewards

- Organizational alignment

- Engagement

- Innovation

- Organizational effectiveness

- Direct management

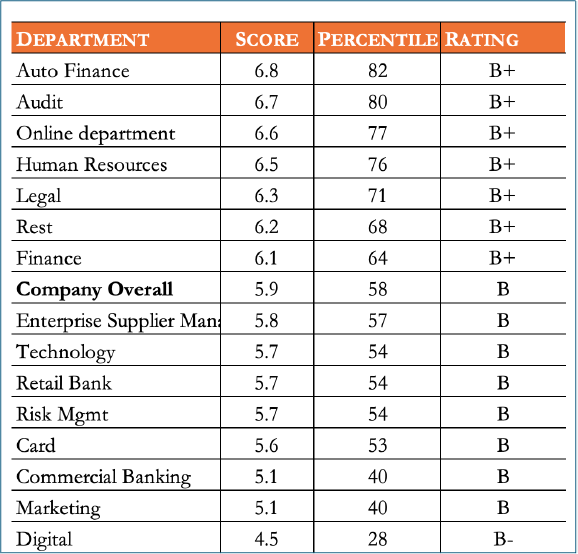

- With an HCF overall rating of 5.9, it is in the 58th percentile in its sector, giving it a B rating.

- The top third (“investment grade”) in its sector starts around 6.4.

- The analysis says the biggest lift would come from improving engagement and organizational effectiveness, meaning efforts should target those issues.

- “We’re slightly above average, but we’re leaving value on the table. Data tells us that improving Engagement and Organizational Effectiveness is the fastest path to stronger performance and equity value.”

- Now everyone understands that this isn’t a human resources vanity project. It’s a growth lever.

Step 2: Use the Analysis Like an X-Ray

The power of HCF is in the slices, the company believes. Don’t just stare at the overall number, the company suggests, ask:

-

Which departments are strongest and weakest?

- Where is Engagement low? Where is Organizational Effectiveness low?

-

How do managers feel vs. frontline teams?

- If Management is A- and Teams are B, that’s a gap in perception.

-

Newcomers vs. longtimers?

-

If newcomers score higher, your onboarding is working but your long-term employee experience is deteriorating.

-

If newcomers score higher, your onboarding is working but your long-term employee experience is deteriorating.

-

Gender and region differences?

- Any meaningful gap here is both a risk and an opportunity for targeted improvement.

- Green = strong

- Yellow = okay

- Red = needs attention

Step 3: Pick a Few Clear Priorities (and Stick to Them)

The company says that the report already does some of the prioritization for organizations with “focus points” – essentially, where one point of improvement in a dimension yields the biggest jump in overall HCF percentile.

At the company level, one might see:

- Focus: Engagement

- Focus: Organizational effectiveness

- Team engagement

- Newcomer engagement

- Team organizational effectiveness

- “Our human capital strategy will focus on improving engagement and organizational Effectiveness – especially for frontline teams and newcomers – to move from the mid-50s percentiles toward top quartile.”

- HR strategy

- Leadership goals

- Business unit scorecards

- Quarterly reviews

Step 4: Translate Each Dimension into Concrete Management Actions

This is where the report excels, the company believes. The guidance sections for each dimension basically hand the company a menu of likely root causes and practical solutions. For instance.

A. Organizational Effectiveness: “Can people actually do great work here?” Low scores here usually mean:

- Training gaps

- Poor cross-team collaboration

- Cumbersome processes, unclear decision rights, constant friction

-

Run a skills and tools audit in two to three critical departments.

- Ask: “What’s the one skill or tool that would make your job meaningfully easier?”

-

Host ‘friction sessions’ between key departments (e.g., Digital and Marketing, Commercial Banking and Operations).

- Put the question on the wall: “What slows you down that we control?”

-

Simplify processes and clarify who decides what.

- Map a few everyday workflows and deliberately remove steps, handoffs, or approvals.

B. Engagement: “Do people bring energy and discretionary effort?”

Low engagement often shows up as:

- People doing the bare minimum

- Low sense of appreciation

- Fuzzy career paths

- Misaligned job expectations

-

Set an “appreciation tone” from the top.

- Expect every manager to recognize specific contributions regularly – not just at review time.

-

Make growth visible and real.

- Two structured career conversations per year, minimum.

- Even if promotion slots are limited, offer projects, lateral moves, skills development.

-

Revisit job expectations with long-timers.

- “How close is your current role to what you thought it would be?”

-

Where misalignment is chronic, fix the role, not the person.

-

Treat engagement as ongoing, not an annual event.

- Put “culture and engagement impact” on the agenda of every leadership meeting.

- Ask, “What did we do this month that helped or hurt engagement?”

Step 5: Use HCF to Tune Core HR Practices

Once you see where your strengths and gaps are, the company says you can calibrate your people systems:

-

Recruiting and employer brand

- Sell your real strengths (e.g., Innovation, Alignment), not a generic “great culture.”

- Be honest about what you’re improving; high-caliber talent respects that.

-

Onboarding

- If newcomers score higher than longtimers, double down on what works in year one.

- Design a first-year journey intentionally so that positive experience doesn’t taper off.

-

Manager development

- Tie manager success partly to HCF scores for Team Engagement and Direct Management.

- Train managers specifically on the weak dimensions: feedback, recognition, coaching, prioritization.

-

Rewards & recognition

- If Extrinsic Rewards is only mid-pack, revisit comp positioning where it matters most.

- Even more importantly, communicate your total rewards story clearly; many employees don’t realize their full package.

-

DEI and inclusion

- Any meaningful gap by gender, region, or tenure is an early warning signal.

- Use focus groups and pulse surveys to understand what’s really going on there.

Step 6: Connect HCF to Turnover, Productivity, and Customer Outcomes

To really cement this in the minds of the C-suite and investors:

-

Compare high vs. low HCF teams on:

- Voluntary turnover

- Regretted attrition

- Sales per FTE (full time employee)

- Productivity/quality metrics

- Customer measures

- “Teams in the top quartile for Engagement have 30% lower turnover and 15% higher sales per FTE than teams in the bottom quartile.”

- Now human capital is visibly tied to hard business performance, and HCF becomes a core part of your strategy narrative.

Step 7: Make HCF Part of Your Operating Rhythm

Finally, build a simple cadence. The company urges clients to:

1. Conduct full HCF ratings every year or two.

2. Conduct quarterly pulses on the top two–three dimensions (e.g., Engagement, Organizational Effectiveness, Direct Management).

3. After each wave:

- Share results with leaders and managers.

- Ask each team to pick one concrete action.

- Check in next quarter: “What did we try? What changed?”

Enterprise Engagement Alliance Services

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:1. Information and marketing opportunities on stakeholder management and total rewards:

- ESM Weekly on stakeholder management since 2009. Click here to subscribe; click here for media kit.

- RRN Weekly on total rewards since 1996. Click here to subscribe; click here for media kit.

- EEA YouTube channel on enterprise engagement, human capital, and total rewards since 2020

Management Academy to enhance future equity value for your organization.

Management Academy to enhance future equity value for your organization.3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

Contact: Bruce Bolger at TheICEE.org; 914-591-7600, ext. 230.