Maturity Index Helps Guide More Effective Management

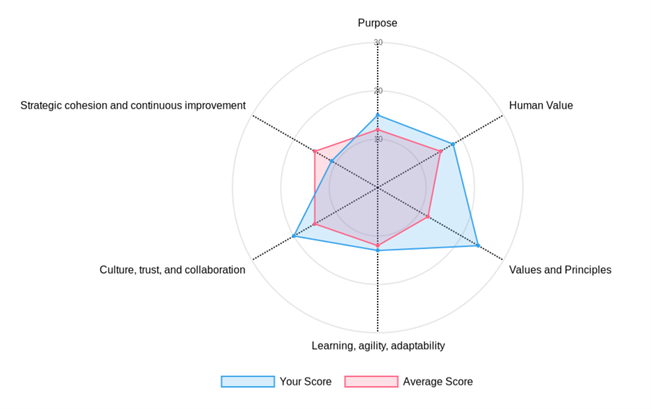

Worker attitudes highlight changing behaviour. it’s time to measure how purpose and values drive human performance. A free online Maturity Index assessment is available to help organizations track their progress toward optimizing results through people.

- ESG and Performance Requires New Metrics and Insights

- Defining Value in a Healthy Organisation

- Worker Insights in an ESG World

The Financial Times recently reported that the Big 4 audit firms are struggling to attract new talent. Twenty-years after the Enron scandal and collapse of Arthur Andersen, it seems that two decades of myriad audit failures have finally taken their toll. The diminished reputation of accounting is causing people to choose alternative career paths.

This is not an isolated example.

Just Capital’s 2021 survey of American workers tells us that attitudes have shifted. American workers want “good jobs”, fair pay and accountability. The message goes deep. People want to work for organizations that go beyond the pursuit of profit. They want employers to integrate the interests of ‘stakeholders’ such as workers, customers, communities and the environment too. This is a profound and powerful shift. Organizations not responding will struggle to compete, especially as other stakeholders are also driving this momentum.

Organizational success now marries responsibility and performance. For individuals who would like to see how their employer or company measures up, our organization offers a free 10-minute assessment that provides an immediate report into a company’s maturity. The anonymous data that comes out of this is used to assess critical ESG (Environmental, Social, Governance) issues of interest to key stakeholders such as investors, researchers, and policy makers. These issues include how trust, authenticity, and corporate responsibility are experienced in reality, and the extent to whether organisations are managing their human capital to maximize potential value and minimize risk. Click here to view and take this assessment.

Investors and regulators are driving change through ESG, which has become an investment mantra companies must address (or risk dis-investment). CEOs are becoming acutely aware of this new imperative, and many are taking action. ESG in the form of responsible business strategies is moving onto executive agendas. New stakeholder value business models are emerging.

Yet, many firms are struggling in the transition. This is because of an overarching challenge that dominates decision making. How can a firm develop a responsible business that serves society but does not trade off financial performance? For C-suite executives brought up on a diet of profit maximization, re-learning stakeholder business strategy is not just challenging. It has cost some their job, as Time Magazine recently highlighted with Danone’s former CEO Emmanuel Faber, who was pushed out by shareholders impatient with his stakeholder approach.

Do CEOs now face an impossible dilemma: Either to please their shareholders, or to join the fight for climate preservation and social equity? Faber had placed those issues at the core of the company. While that brought applause...the company’s shares lagged behind peers.

Of course, who wouldn’t want to work for a high performing, purposeful company--one that recognizes its social responsibilities and achieves these together with strong financials-- success that can only arise by galvanizing all human talent, without having to trade off people for profit. Is this even possible?

ESG and Performance Requires New Metrics and Insights

This dilemma has been confronted by the Maturity Institute (MI) since its 2012 inception. By developing frameworks and methodologies that analyse ‘Organizational Maturity’, MI has demonstrated that societal value and financial outperformance are already being achieved by exemplary firms.

Organizational Maturity comprises a measurable set of leadership and management systems (and practices). Maturity analysis examines the critical human drivers within such systems and practices: drivers that are causally connected with the generation of material value and risk. These factors include corporate purpose, strategic cohesion, human governance, trust, collaboration, decision-making, learning, innovation, and performance management.

In analysing these factors, Organizational Maturity describes a mutually inclusive, holistic system, value paradigm in which every societal stakeholder can benefit from corporate activity. Higher levels of Organizational Maturity link with better financial, human, and environmental outcomes. As the University of Cambridge Judge Business School (2019) articulated in a preliminary summary of MI data:

"A company can maximize profits and create wealth for shareholders mainly by establishing a mature institution that enhances wellbeing for all legitimate stakeholders as well as creates positive externalities to the environment and wider society.”

MI’s work distils critical lessons from its exemplary firms into a coherent form. It shows how Maturity underpins success in reconciling responsibility and financial value. For example, exemplary companies such as Toyota, Handelsbanker, and Mercadona have outperformed for society and their shareholders over many decades. Each exemplary company has common characteristics that define the nature of effective, mature systems and practices.

Defining Value in a Healthy Organisation

In the new ESG paradigm, boards and executives must adopt broader diagnostics. Corporate health needs to be assessed according to total value created for all stakeholders. Stakeholder rather than just shareholder value.

For MI, OMINDEX® (Organizational Maturity Index) is a recognized diagnostic standard. Today, its 32-questions are analysed by investment professionals, senior executives, and advisory firms. Crucially, it works as a holistic instrument. This means that it helps to uncover the nuanced interplay between material factors within a firm’s whole system. Factors such as learning, innovation, reward, and decision-making. OMINDEX® also examines company stakeholders, answering the fundamental question of how value and risk are created and managed within each one.

MI is the only independent, not-for-profit institution, that sets ESG diagnostic standards. In a world where commercial competition for ESG data standards is intense, examples of “greenwashing” can be all too common.

Worker Insights in an ESG World

Boards and C-suites are under enormous pressure to integrate stakeholder interests within business models and strategy. For many investors and regulators, such as the SEC (US Securities & Exchange Commission), it is the workforce where firms must focus primary attention.

But how can firms demonstrate that their workforce culture is healthy? Is their workforce is aligned with purpose and values? Can people realize their potential in contributing to success? Companies need to develop credible evidence, showing the reality of how workers view their firm and their role in its success, but defined by reference to ESG and total value creation.

To help, we have developed OMINDEX® Workforce, a version of the full OMINDEX® diagnostic tool, that captures critical employee data. For those firms that have historically measured worker engagement, this simple 15-question survey is easily integrated into existing approaches. In fact, it adds a crucial dimension while its data yields important new insights. Measures of corporate culture, human performance and people related risk that help to better align purpose, values, and value creation. Enabling a transition to higher levels of maturity can start immediately.

For More Information

Stuart Woollard, Council Member

Maturity Institute

Click here for general information.

To try the OMINDEX® Workforce survey, click here.

Master the “S” of Environmental, Social, Governance (ESG), A.k.a. Stakeholder Capitalism

The Enterprise Engagement Alliance at TheEEA.org is the world’s first and only organization that focuses on outreach, certification and training, and advisory services to help organizations achieve their goals by fostering the proactive involvement of all stakeholders. This includes customers, employees, distribution and supply chain partners, and communities, or anyone connected to an organization’s success.

Training and Thought Leadership

- Founded in 2008, the Enterprise Engagement Alliance provides outreach, learning and certification in Enterprise Engagement, an implementation process for the “S” or Social of Stakeholder Capitalism and Human Capital Management and measurement of engagement across the organization.

- The Enterprise Engagement Alliance provides a training and certification program for business leaders, practitioners, and solution providers, as well as executive briefings and human capital gap analyses for senior leaders.

- The EEA produces an education program for CFOs for the CFO.University training program on Human Capital Management.

- Join the EEA to become a leader in the implementation of the “S” of ESG and Stakeholder Capitalism.

- The ESM information portal and The Enterprise Engagement Advisors Network solution provider marketplace cover all aspects of stakeholder engagement, and the EEA information library lists dozens of resources.

- The RRN information portal and Brand Media Coalition marketplace address the use of brands for gifting, incentives, recognition, and promotions. The BMC information library provides information and research resources.

Video Learning

The EEA Human Capital Management and ROI of Engagement YouTube channel features a growing library of 30- to 60-minute panel discussions with leading experts in all areas of engagement and total rewards.

- Enterprise Engagement for CEOs: The Little Blue Book for People-Centric Capitalists. A quick guide for CEOs.

- Enterprise Engagement: The Roadmap 5th Edition implementation guide. A comprehensive textbook for practitioners, academics, and students.

Enterprise Engagement Advisory Services

The Engagement Agency helps:

- Organizations of all types develop strategic Stakeholder Capitalism and Enterprise Engagement processes and human capital management and reporting strategies; conduct human capital gap analyses; design and implement strategic human capital management and reporting plans that address DEI (Diversity, Equity, and Inclusion), and assist with managed outsourcing of engagement products and services.

- Human resources, sales and marketing solution providers profit from the emerging discipline of human capital management and ROI of engagement through training and marketing services.

- Investors make sense of human capital reporting by public companies.

- Buyers and sellers of companies in the engagement space or business owners or buyers who seek to account for human capital in their mergers and acquistions.

For more information: Contact Bruce Bolger at Bolger@TheICEE.org or call 914-591-7600, ext. 230.