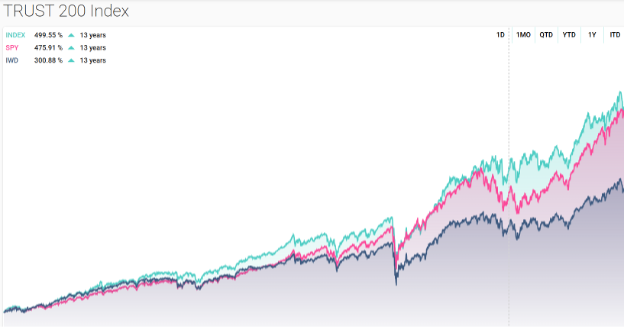

Trust 200 Index Outperforms Its Benchmarks Over 13 Years

Here is yet more evidence that organizations based on ethical management practices do not sacrifice returns for shareholders.

Here is yet more evidence that organizations based on ethical management practices do not sacrifice returns for shareholders.Click here for links to information about EEA sponsors; here to subscribe to ESM weekly; here for an ESM media kit.

The Trust 200 Index reportedly has outperformed its two benchmarks over 13 years since inception, producing a 499.95% return, versus the SPY Index at 475.12% and IWD (iShares Russell 1000 Value ETF) at 297.45%.

The Trust 200 Index was created by Trust Across America-Trust Around the World, whose mission is to help enhance trustworthy behavior in business. The organization was founded following the 2008 financial crisis by Barbara Brooks Kimmel, a long-time communications executive and before that a consultant at McKinsey.

The Trust 200 Index was created by Trust Across America-Trust Around the World, whose mission is to help enhance trustworthy behavior in business. The organization was founded following the 2008 financial crisis by Barbara Brooks Kimmel, a long-time communications executive and before that a consultant at McKinsey.Click here for a chart showing the results since inception.

The trust uses Index One, a platform that provides financial professionals with tools for index design, distribution, and calculation, to independently validate the results. The Trust Index is based on what it calls its FACTS framework:

- Financial stability

- Accounting conservativeness

- Corporate governance

- Transparency

- Sustainability

Among the specific factors considered are corporate integrity, board independence, litigation and regulatory issues, officer changes, diversity and human rights disclosures, community policies, and environmental disclosures.

“Our mission has been to highlight the most trustworthy companies as beacons of light for all others,” explains Kimmel. “Setting up the index was a way to prove (or disprove) our hypothesis that the most trustworthy companies would outperform their less trustworthy peers. You will note that the top 10 companies leading the index year-to-date are listed on the index page link above. We hope that our visitors will find it useful.

Ten years ago, Trust Across America-Trust Around the World (TAA-TAW) created the FACTS® Framework to evaluate the trustworthiness of public companies, incorporating quantifiable metrics and data. Using that framework, the organization reports that it quantitatively screens 1,500 of the largest US public companies based on publicly available data. The companies do not participate in the analysis, nor are any internal assessments or surveys completed, the organization says.

Coincidentially, the Enterprise Engagement Alliance and EGR International sponsored the Engaged Company Stock Index study, based on a portfolio managed by the McBassi and Company analytics firm based on 13 metrics related to customer, employee, and community engagement. It outperformed the S&P 500 by over 37.1% from October 1, 2012 to June 30, 2018.

Enterprise Engagement Alliance Services

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

Celebrating our 15th year, the Enterprise Engagement Alliance helps organizations enhance performance through:

1. Information and marketing opportunities on stakeholder management and total rewards:

- ESM Weekly on stakeholder management since 2009. Click here to subscribe; click here for media kit.

- RRN Weekly on total rewards since 1996. Click here to subscribe; click here for media kit.

- EEA YouTube channel on enterprise engagement, human capital, and total rewards since 2020

Management Academy to enhance future equity value for your organization.

Management Academy to enhance future equity value for your organization.3. Books on implementation: Enterprise Engagement for CEOs and Enterprise Engagement: The Roadmap.

4. Advisory services and research: Strategic guidance, learning and certification on stakeholder management, measurement, metrics, and corporate sustainability reporting.

5. Permission-based targeted business development to identify and build relationships with the people most likely to buy.

Contact: Bruce Bolger at TheICEE.org; 914-591-7600, ext. 230.